Buy your first home with confidence

Buying a house doesn’t need to be stressful.

You just need the right team to support you.

Does this sound familiar?

You want to make a move but you’re nervous

You’re unsure whether you can afford to buy your first home. You’re feeling a little out of your depth. You’ve got some idea of what’s involved, but you’ve spent more time looking for the perfect house to buy, rather than working out how to buy one.

You want to do things the right way, but you’re short on time

Between your full time job, training for that gym challenge you signed up for and attending yet-another-wedding, you don’t have time to look into loan structuring options; perform cost-benefit analysis; prepare repayment tables and amortisation charts; or look at market trends. But, you realise some of this is probably required, before you lock yourself in to a 30 year mortgage.

You can talk the talk, but you’re not really sure what you’re doing

You’ve never bought a house before, so how can you possibly know what to do?! The only bank you’re familiar with is the one your salary goes into and if you’re being honest here, you’ve maybe walked into the branch once? There’s a lot of terminology you need to understand before you sign on the dotted line and hand over any money.

You want the green light to make an offer

You’ve got your deposit sorted and an online repayment calculator says you can afford a loan. But you’re not sure it’s safe to make an offer just yet and hand over your hard-earned deposit. (Don’t pay anything yet – there are a few things you need to do first.)

You’re concerned you’ll pay too much by choosing the wrong home loan

Comparing one loan with another is not as simple as it seems. The interest rates and fees differ, but so do loan features and how much each lender will allow you to borrow. It’s hard to know you’ve gone with the right loan without knowing what every other lender is offering. But if you make the wrong decision, it could cost you thousands of dollars in interest over the next few years.

You want to talk to someone who has the answers, not creates more questions

You’ve been asking family and friends so many questions about their house buying experiences, but you’re feeling overwhelmed by their conflicting responses. You think it might be time to talk to professionals anyway. Professionals who help first home buyers day in and day out. A team who will answer your questions based on industry knowledge, not from a once-off personal experience.

Does this sound familiar?

You want to make a move but you’re nervous

You’re unsure whether you can afford to buy your first home. You’re feeling a little out of your depth. You’ve got some idea of what’s involved but you’ve spent more time looking for the perfect house to buy, rather than working out how to buy one.

You want the green light to make an offer

You’ve got your deposit sorted and an online repayment calculator says you can afford a loan. But you’re not sure if that means it’s safe to make an offer now and hand over your hard-earned deposit. (Don’t pay anything yet – there are a few things you need to do first.)

You want to do things the right way, but you’re short on time

Between your full time job, training for that gym challenge you signed up for and attending yet-another-wedding, you don’t have time to look into loan structuring options; perform cost-benefit analysis; prepare repayment tables and amortisation charts; or look at market trends. But, you realise some of this is probably required, before you lock yourself in to a 30 year mortgage.

You can talk the talk, but you’re not really sure what you’re doing

You’ve never bought a house before so how can you possibly know what to do?! The only bank you’re familiar with is the one your salary goes into and if you’re being honest here, you’ve maybe walked into the branch once? There’s a lot of terminology you need to understand before you sign on the dotted line and hand over any money.

You’re concerned you’ll pay too much by choosing the wrong home loan

Comparing one loan with another is not as simple as it seems. The interest rates and fees differ, but so do loan features and how much each individual lender will allow you to borrow. It’s hard to know you’ve gone with the right loan without knowing what every other lender is offering. But if you make the wrong decision, it could cost you thousands of dollars in interest over the next few years.

You want to talk to someone who has the answers, not creates more questions

You’ve been asking family and friends so many questions about their house buying experiences, but you’re feeling overwhelmed by their conflicting responses. You think it might be time to talk to professionals anyway. Professionals who help first home buyers day in and day out. A team who will answer your questions based on industry knowledge, not from a once-off personal experience.

It’s ok. We’re here to help.

With so much information available online, it’s more confusing than ever to work out which home loan is best for you.

Add in constant changes to the Australian banking industry and it’s no wonder you’re feeling overwhelmed as a first home buyer.

It’s the reason why so many borrowers walk into their existing bank and just say ”yes” to the first loan they’re offered. This may seem like the simplest option, but the wrong loan can cost you thousands more in the long run #goodbyefutureholidays

The good news is that you don’t have to navigate the process alone – we’re here to help.

Who are we? Who is MMO?

MO’R Mortgage Options (MMO) is a family team of mortgage brokers.

Our story starts more than two decades ago, when Founder Michael O’Reilly began buying and selling property. Michael conducted EXTENSIVE research into his financing options because he didn’t want to pay a single cent more than he had to. And after personally speaking with numerous lenders, Michael discovered he wasn’t always offered the best solution or technical lending advice.

Michael knew that borrowers were accepting these second-rate home loan options because they were unaware of what else was available. He wanted to share what he’d learnt with others, so they too could create strong financial foundations for their families. Michael opened the doors to MMO in July 2000, committed to do exactly that.

Since that day, Michael has helped thousands of clients improve their finances, simply by better managing their mortgages – families we continue to assist today. And just like a good recipe, for more than 2 decades, the financing structures, lender knowledge and technical-know-how has been passed down to the next generation with Michael’s sons Daniel and Brendan and daughter Kathryn, today leading our growing team of mortgage brokers.

Get the support you need to buy your first home with confidence.

We’re here to help.

Who are we? Who is MMO?

MO’R Mortgage Options (MMO) is a family team of mortgage brokers.

Our story starts more than two decades ago, when Founder Michael O’Reilly began buying and selling property. Michael conducted EXTENSIVE research into his financing options because he didn’t want to pay a single cent more than he had to. And after personally speaking with numerous lenders, Michael discovered he wasn’t always offered the best solution or technical lending advice.

Michael knew that borrowers were accepting these second-rate home loan options because they were unaware of what else was available. He wanted to share what he’d learnt with others, so they too could create strong financial foundations for their families. Michael opened the doors to MMO in July 2000, committed to do exactly that.

Since that day, Michael has helped thousands of clients improve their finances, simply by better managing their mortgages – families we continue to assist today. And just like a good recipe, for more than 2 decades, the financing structures, lender knowledge and technical-know-how has been passed down to the next generation with Michael’s sons Daniel and Brendan and daughter Kathryn, today leading our growing team of mortgage brokers.

Get the support you need to buy your first home with confidence.

We’re here to help.

What do you get when you work with us?

Clarity around how much you can spend

Don’t risk your hard-earned deposit by bidding at Auction without an official ‘green light’ from a lender. We’ll conduct a thorough investigation into all your lending options and let you know exactly how much you can afford to pay for your new home. In no time at all, you’ll be house hunting with confidence.

A step-by-step action plan to purchase your home

We’ll explain each stage of the buying process so you know exactly what’s going to happen (and when). You’ll never be left wondering where things are up to with your loan application. Work with us and you’ll have someone on your side, helping and guiding you through each stage of the purchasing process – answering all of your questions along the way.

A personal Project Manager

You’ll have someone to manage the entire process for you. We will chase your application with the lender, liaise with the agent and work closely with your solicitor. You’ll have someone working behind the scenes to ensure everything is moving along quickly, so you can move into your new home ASAP.

Round-the-clock Support

Some lenders process applications around the clock, meaning questions can be asked about your loan application outside of business hours and on weekends. It’s our job to handle all these queries, whenever they’re asked. The same goes for your questions. Ask us anything and we’ll always do our best to respond quickly and comprehensively.

Tailored home loan solution, bespoke advice

There is never a ‘one-fits-all’ lending solution. Before we recommend a lending solution, we conduct a thorough investigation to ensure it’s the right fit. This means we’ll have conversations with lenders, double check lending policy and perform servicing calculations. Even better than knowing you’ve got the right loan, is knowing WHY it’s superior against the alternatives. That’s what you get when you work with us.

Plain-language finance solutions, with YOU at the centre of the equation

Say goodbye to nodding along with the guy at the bank when he starts talking in lending acronyms. The thing is, most lenders explain things from their own perspective not how it impacts you – the borrower. When we turn it around and consider everything from YOUR perspective (ie. How convenient is that for you? How does that change impact you? Does that particular loan feature provide you with benefit, or does it just make it easier for the lender to retain your business later on?) suddenly things aren’t so complicated.

As much (or as little) analysis as you like

If you’re someone who wants all the charts and tables and comparison analysis before taking action, that’s what you’ll get. If you’re more of a ‘big picture’ person and prefer loan structure diagrams instead, that’s what you’ll get. You call the shots, not the other way round. You’ll get everything you need to understand the ins and outs of your first home loan.

Fast turn-around (so you won’t miss out on that property)

The secret to getting your home loan approved quickly is knowing exactly how your lender likes to see applications presented. When you choose a mortgage broker who has been working with lenders for almost two decades – a team with intricate knowledge of the internal processing systems of Australia’s largest (and smallest) lenders – you can be sure your application will be presented in *just* the right way to get it approved fast.

Support from an entire team

It’s frustrating when your question can’t be answered or progress just stops, “because Jimmy’s away and no-one else can help you.” When you work with a mortgage broker at MMO, you get the support of our entire team – there’s always someone who can help you. Client feedback told us this was important. So many years ago, we restructured our business accordingly. It’s also the reason why many of our client reviews mention more than one person – we work in small teams to ensure you receive the best service possible.

What do you get when you work with us?

Clarity around how much you can spend

Don’t risk your hard-earned deposit by bidding at Auction without an official ‘green light’ from a lender. We’ll conduct a thorough investigation into all your lending options and let you know exactly how much you can afford to pay for your new home. In no time at all, you’ll be house hunting with confidence.

A step-by-step action plan to purchase your home

You’ll never be left wondering where things are up to with your loan application or what needs to happen next. You’ll have someone on your side, helping and guiding you through each stage of the purchasing process – answering all of your questions along the way.

Tailored home loan solution, bespoke advice

There is never a ‘one-fits-all’ lending solution. Before we recommend a lending solution, we conduct a thorough investigation to ensure it’s the right fit. This means we’ll have conversations with lenders, double check lending policy and perform servicing calculations. Even better than knowing you’ve got the right loan, is knowing WHY it’s superior against the alternatives. That’s what you get when you work with us.

Plain-language finance solutions, with YOU at the centre of the equation

Say goodbye to nodding along with the guy at the bank when he starts talking in lending acronyms. The thing is, most lenders explain things from their own perspective not how it impacts you – the borrower. When we turn it around and consider everything from YOUR perspective (ie. How convenient is that for you? How does that change impact you? Does that particular feature provide you with benefit, or does it just make it easier for the lender to retain your business later on?) suddenly things aren’t so complicated.

A personal Project Manager

You’ll have someone to manage the entire process for you. We will chase your application with the lender, liaise with the agent and work closely with your solicitor. You’ll have someone working behind the scenes to ensure everything is moving along quickly, so you can move into your new home ASAP.

Round-the-clock Support

Some lenders process applications around the clock, meaning questions can be asked about your loan application outside of business hours and on weekends. It’s our job to handle these queries, whenever they’re asked. The same goes for your questions. Ask us anything and we’ll always do our best to respond quickly and comprehensively.

As much (or as little) analysis as you like

If you’re someone who wants all the charts and tables and comparison analysis before taking action, that’s what you’ll get. If you’re more of a ‘big picture’ person and prefer loan structure diagrams instead, that’s what you’ll get. You call the shots, not the other way round. You’ll get everything you need to understand the ins and outs of your first home loan.

Fast turn-around (so you won’t miss out on that property)

The secret to getting your home loan approved quickly is knowing exactly how your lender likes to see applications presented. When you choose a mortgage broker who’s been working with lenders for almost two decades – a team with intricate knowledge of the internal processing systems of Australia’s largest (and smallest) lenders – you can be sure your application will be presented in *just* the right way to get it approved fast.

Support from an entire team

It’s frustrating when your question can’t be answered or progress just stops, “because Jimmy’s away and no-one else can help you.” When you work with a mortgage broker at MMO, you get the support of our entire team – there’s always someone who can help you. Client feedback told us this was important. So many years ago, we restructured our business accordingly. It’s also the reason why many of our client reviews mention more than one person – we work in small teams to ensure you receive the best service possible.

Let’s hear from some first home buyers…

Daniel and Greg were absolutely fantastic during the whole process of purchasing our first home.

Read MoreBrendan O’Reilly and Michael Baker assisted me with my mortgage.

Read MoreEfficient service, regular contact throughout the whole process. Karen Ajaye was amazing and held my hand through the whole process.

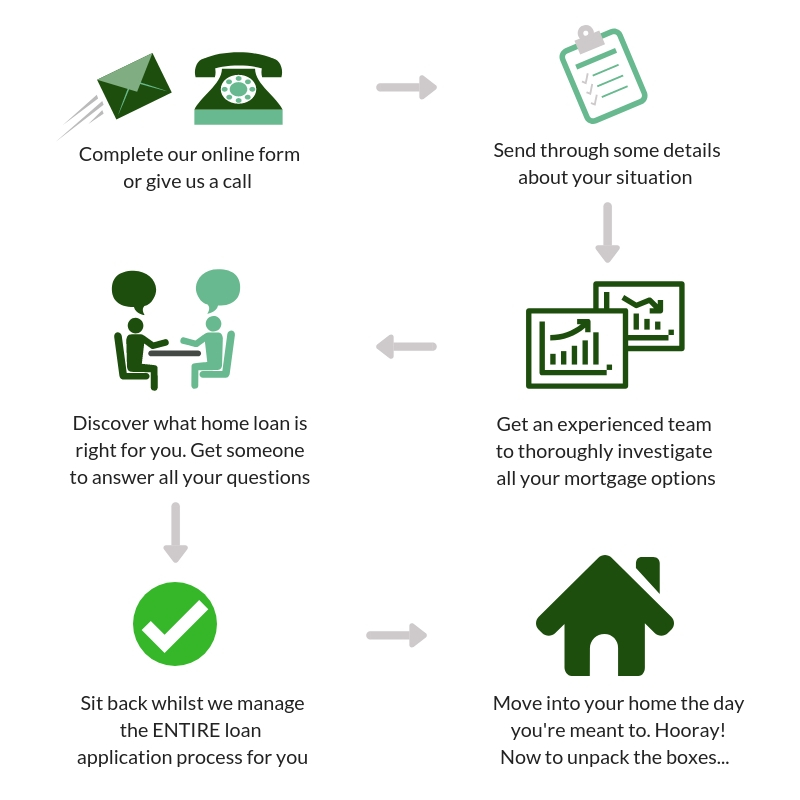

Read MoreWhat does working with us look like?

You’ll get immediate access to:

How much does our First Home Buyer Service cost?

You’ve never worked with a broker before, so you may not know that our service is provided to you completely free of charge.

Yep, that’s right. You pay us nothing.

We do not charge for our service. This is not a fee-for-service transaction.

We’ll help you find the right home loan and support you through every step of buying your first home. And then, we’ll help you manage your loan for as long as you have it. We’re serious about making sure you NEVER pay more interest than you have to.

Spend the next ten years benefiting from our knowledge, industry experience and technical know-how without it costing you a single cent. In fact, we’re confident you will save money.

— So how do we get paid then? —

Mortgage brokers are paid directly by the lender, if and when they help you secure a loan.

We’re completely transparent and upfront about this and will advise how much this could be when we talk to you about your loan options.

A mortgage broker can access the same loan products and same home loan rates you could obtain directly from a lender. It’s true we can negotiate additional rate discounts on your behalf, but the real benefit is in us helping you find the right loan from the right lender. And helping you every step of the way.

Get stated today and you’ll also receive these additional benefits…

Here are more reasons to work with us:

We can share buying tips

Don’t pay more for your new home than you have to! We can reveal tips on how to negotiate the best purchase price; share strategies used by experienced property buyers to determine the value of a property; provide auction support; PLUS pass on the lessons we’ve learnt over the last two decades helping clients purchase property all over Australia.

Regular home loan reviews

We’re on a mission to ensure no client ever pays more for their home loan than necessary. This means we’ll touch base with you periodically to review your loans to check whether they’re still competitive. This is a completely free service. And if you’re ever concerned about your loans – or something doesn’t quite seem right – we’re only an email away.

Get access to our growing Resource Library

As a client, you’ll have access to our growing library of industry-related articles, flowcharts, e-books, money-saving checklists and all our other resources. You’ll also receive the Special Reports we generate from time to time covering the Canberra Property Market – revealing suburb trends, property price growth patterns, changes in land values and housing affordability changes in our region.

Join our Client Referral Program

Take the opportunity to be rewarded periodically with gifts and vouchers from some of Canberra’s best service providers and restaurants – simply by recommending us to your family and friends.

Work with Canberra’s best property service providers

Over the years, we’ve worked with just about everyone in town. Based on this experience and more importantly, feedback from our clients, we’ve created a “Best of the Best” List of Canberra’s best real estate agents, property managers, solicitors, accountants, financial planners and quantity surveyors. If you need help managing any aspect of the home purchasing process, we can put you in touch with the right people.

Receive Regular Updates

Every few months, we summarise what has been happening in the industry, provide commentary on market developments and/or potential interest rate movements and deliver it straight to your inbox. You already get a tonne of emails – most of which probably waste your time. We aim to keep our updates short and to the point, with the sole purpose of highlighting things can may affect you and your loans (so you can do something about it if necessary).

More reasons to work with us:

We can share buying tips

Don’t pay more for your new home than you have to! We can reveal tips on how to negotiate the best purchase price; share strategies used by experienced property buyers to determine the value of a property; provide auction support; PLUS pass on the lessons we’ve learnt over the last two decades helping clients purchase property all over Australia.

Regular home loan reviews

We’re on a mission to ensure no client ever pays more for their home loan than necessary. This means we’ll touch base with you regularly to review your loans to check whether they’re still competitive. This is a completely free service. And if you’re ever concerned about your loans – or something doesn’t quite seem right – we’re only an email away.

Get access to our growing Resource Library

As a client, you’ll have access to our growing library of industry-related articles, flowcharts, e-books, money-saving checklists and all our other resources. You will also receive the Special Reports we generate from time to time covering the Canberra Property Market – revealing suburb trends, property price growth patterns, changes in land values and housing affordability changes in our region.

Join our Client Referral Program

Take the opportunity to be rewarded with gifts and vouchers from some of Canberra’s best service providers and restaurants – simply by recommending us to your family and friends.

Work with Canberra’s best property service providers

Over the years, we’ve worked with just about everyone in town. Based on this experience and more importantly, feedback from our clients, we’ve created a “Best of the Best” List of Canberra’s best real estate agents, property managers, solicitors, accountants, financial planners and quantity surveyors. If you need help managing any aspect of the home purchasing process, we can put you in touch with the right people.

Receive Regular Updates

Every few months, we summarise what has been happening in the industry, provide commentary on market developments or potential interest rate movements and deliver it straight to your inbox. You already get a tonne of emails – most of which probably waste your time. We aim to keep our updates short and to the point, with the sole purpose of highlighting things that can affect you and your loans (so you can do something about it if necessary).

What do other first home buyers say about us?

Could not recommend these guys more! I wish there were 10 stars!

Read MoreWe had the best customer service ever since we come to Australia. They make the process simple and easy, always available for questions and with a great attitude.

Read MoreMichael Baker was the best broker we could have asked for!

We had very little knowledge of the home buying and loan process and Michael was able to help us through every stage!

Read MoreFrequently Asked Questions

I’ve never used a mortgage broker before, why can’t I just talk to my bank?

You can – you can just talk to your bank.

But when you work with us, you have access to a whole host of lenders, meaning you’ll get the right loan from the right lender, at the right rate.

We can also show you how to reduce your interest costs using specific loan features and structuring techniques that not surprisingly, lenders aren’t always so forthcoming with!

Can I get a better deal if I go through a mortgage broker?

Mortgage brokers can access exactly the same loan products as what’s available if you walked straight into your local branch.

We can negotiate additional rate discounts on your behalf. But the real benefit is in helping you find the right loan from the right lender so you don’t pay more than you have to.

We also handle everything for you. This means we: do the calculations; present you with the options; package up your application; chase the lender; negotiate discounts, arrange all the paperwork and go over your loan contracts with a fine-tooth comb before you sign anything.

If you take into account all the added benefits you receive (at no cost) by working with us, it’s easy to see why growing numbers of first home buyers are choosing to work with mortgage brokers.

Are you sure there are no hidden fees to use your services?

There no fees for our service.

We do NOT charge any fees to calculate your Borrowing Capacity, analyse your lending options, prepare repayment tables, or tailor a loan structure to suit your objectives.

Likewise, we do NOT charge any fees to lodge your loan application, managing the entire process from start to finish. Nor do we charge fees for any of the ongoing services we provide (ie. post-settlement checks; helping you change/ switch your loan later on; or performing home loan reviews).

If we arrange a loan for you, we receive a payment directly from the lender. We’re completely transparent and upfront about this and will advise how much this could be when we talk to you about your loan options.

How long after I talk to you can I make an offer on my first property?

This depends on a few factors. Specific times (i.e. the lead up to Christmas and end of financial year) can be busier for lenders, so sometimes things can take a little longer to be processed on their end.

The faster you provide all your supporting documentation, the faster you’ll get a result.

If you’re thinking of buying your first home soon, it’s ALWAYS better to get your finance in place well before you need it. Otherwise, you’ll find yourself unable to bid at the weekend’s Auction, simply because you were a little slow to get things moving.

I’d prefer to meet before sending you any information about my personal situation. Can I just book an appointment?

We completely understand that it may seem like we’re asking for a lot of information, right at the start. The thing is though, we cannot provide the best service (or accurate credit advice) without detailed information about your situation upfront. Lenders are changing their policies all the time and without a thorough understanding of your position, we’re just guessing what might be possible.

If you want to have a general chat before sending any documentation through, please call us on 02 6286 6501.

We know there may be others out there who don’t ask for much information initially – and that’s completely up to them. We want to deliver the best service possible without wasting your time. We’re continually refining our processes based on client feedback and we’re confident our current systems help us to do exactly that. (Our 5 Star Facebook and Google Review Rating confirms this too.)

Are you currently taking on more First Home Buyer clients?

Being a small family team of mortgage brokers, there’s a limit to the number of new clients we can take on each month.

This suits us perfectly because we’re not interested in being the biggest brokerage in town. Our priority has always been (and still is!) to deliver quality service to quality clients.

We want to help borrowers buy their first home the right way and help them create strong financial foundations for their future.

If this sounds like you, we’d love to help you purchase your first home!

Don’t waste time and money trying to do it all alone.

Get the support you need to purchase your first home the right way.

Click on the button below to get started.

We’ll ask for some contact details and be in touch shortly.