Without a crystal ball, there’s always a bit of guess work involved in picking the absolute best time to fix your home loan.

A question which may be just as relevant is, ‘Why do you want to fix?’

A fixed rate loan is a good option anytime if you’re someone who likes your loan repayments to be exactly the same each month and you like to budget accurately.

If you’re only considering a fixed rate loan to save interest, it’s always tricky to predict the “absolute best time” to lock in.

We have discussed them before, but here are a few tools you can use can help identify what rates are *likely* to do – which is always a good place to start if you’re considering a fixed rate loan.

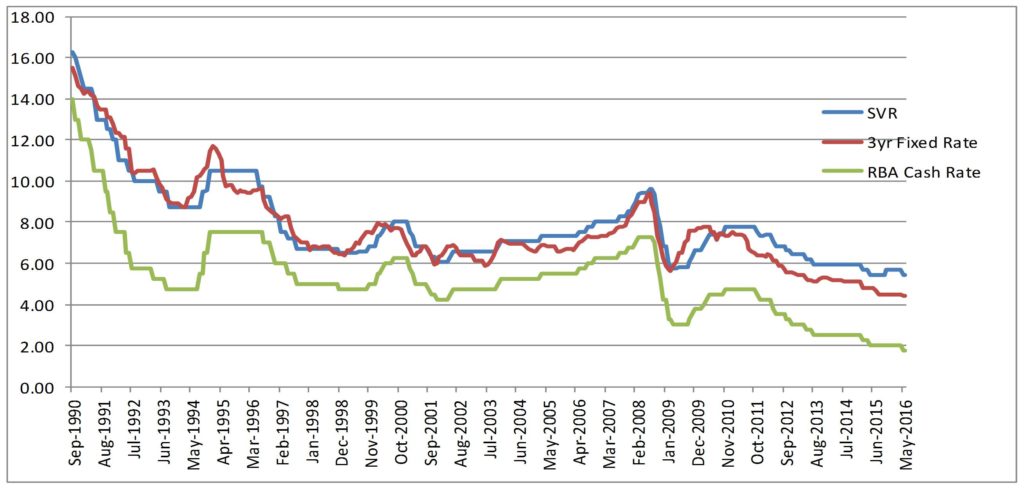

The following charts the RBA Cash Rate, Standard Variable Rate (SVR) and 3yr Fixed Rate over the last 25 years (using indicator lending rates available here from the RBA).

Using technical analysis, you could argue that when the 3yr Fixed Rate moves above the SVR line, it’s possibly indicating the SVR is about to rise (meaning you may do well with a fixed rate). Conversely, when the 3yr Fixed Rate changes direction and moves below the SVR, it could be signalling the SVR is about to drop (and you may be better off with variable rate loan).

Using technical analysis, you could argue that when the 3yr Fixed Rate moves above the SVR line, it’s possibly indicating the SVR is about to rise (meaning you may do well with a fixed rate). Conversely, when the 3yr Fixed Rate changes direction and moves below the SVR, it could be signalling the SVR is about to drop (and you may be better off with variable rate loan).

Of course, these things are always easier to spot when you’re looking back at historical data and there are clear changes in trends.

So, let’s try to look into the future by examining the interbank cash rate futures market. Here, we can see what’s trading at what prices in the future to get an idea of what the market expects rates to do.

Whilst there is still an element of guessing, we’ve found it useful and reasonably accurate in providing a short-medium term outlook on what rates are likely to do (rather than predicting when they may change).

This shows that the market is expecting the SVR to fall further. Let’s see what happens at the RBA’s August meeting next Tuesday.

This shows that the market is expecting the SVR to fall further. Let’s see what happens at the RBA’s August meeting next Tuesday.

After each RBA Meeting, we post updates on Facebook and Linked in. Make sure you’re following us to get the latest interest rate news.