You’re investing in property to create wealth, right?

So why aren’t your loans helping you do that?

Does this sound familiar?

You want to invest the right way

You’ve heard the stories where people invest in property and it all goes horribly wrong due to poorly chosen properties and a poorly executed borrowing strategy. The reason you’re investing in property is to strengthen your position, not to put yourself under financial pressure.

You want someone to ‘take care of it all’

You want the financing process to be as smooth as possible. You don’t want constant requests to provide more documentation and you don’t want to answer the same question three times. You want someone with intricate knowledge of how lenders are currently handling investment loan applications, so that any potential queries/ issues/ roadbumps are anticipated and quickly averted.

You want a service that fits around you

Between travelling for work, the extra hours you’re putting in and home life with kids, time is one thing you’ve never got enough of. In fact, lack of time is one of the main reasons you haven’t added to your portfolio recently. It’s important you work with a team who understands that.

You want to deal with professionals

You work with a high performing team during business hours and want the same when arranging finance for your investment purchase. You want someone you can trust. Not someone who just looks the part and knows the lingo, someone experienced with runs on the board.

You want to get the strategy right

You want your finance structured properly so can achieve the returns you’re looking for. You’ve not been impressed at how frequently Managers seem to change at the local branch or how little they seem to know about investing. Building wealth through property is a long term goal, so it makes sense to enlist help from a team who can be with you over the long term.

You want to work with someone who ‘gets it’

You want someone who understands the intricacies of investment finance. Someone who looks for nuances between lenders to identify opportunities. Someone who can interpret the changing lender landscape and recommend ways to take advantage of the changes yet minimise risk at the same time.

Does this sound familiar?

You want to invest the right way

You’ve heard the stories where people invest in property and it all goes horribly wrong due to poorly chosen properties and a poorly executed borrowing strategy. The reason you’re investing in property is to strengthen your position, not to put yourself under financial pressure.

You want to deal with professionals

You work with a high performing team during business hours and don’t understand why it can’t be the same when arranging finance for your investment purchase. You want someone you can trust. Not someone who just looks the part and knows the lingo, someone experienced with runs on the board.

You want to deal with professionals

You work with a high performing team during business hours and don’t understand why it can’t be the same when arranging finance for your investment purchase. You want someone you can trust. Not someone who just looks the part and knows the lingo, someone experienced with runs on the board.

You want a service that fits around you

Between travelling for work, the extra hours you’re putting in and home life with kids, time is one thing you’ve never got enough of. In fact, lack of time is one of the main reasons you haven’t added to your portfolio recently. It’s important you work with a team who understands that.

You want to get the strategy right

You want your finance structured properly so can achieve the returns you’re looking for. You’ve not been impressed at how frequently Managers seem to change at the local branch or how little they seem to know about investing. Building wealth through property is a long term goal, so it makes sense to enlist help from a team who can be with you over the long term.

You want someone to ‘take care of it all’

You want the financing process to be as smooth as possible. You don’t want constant requests to provide more documentation and you don’t want to answer the same question three times. You want someone with intricate knowledge of how lenders are currently handling investment loan applications, so that any potential queries/ issues/ roadbumps are anticipated and quickly averted.

You want a team who ‘gets it’

You want someone who understands the intricacies of investment finance. Someone who looks for nuances between lenders to identify opportunities. Someone who can interpret the changing lending landscape and recommend ways you can take advantage of the changes and protect yourself at the same time.

It’s ok. We’re here to help.

With all the changes to the Australian banking industry recently, it has become harder to secure investment finance.

Tiered rates for Investment loans and Interest Only repayments, a reduced appetite for investment lending and increased scrutiny of serviceability, means you can no longer submit an application and be assured of an outcome.

It has become critical to enlist the help of an investment finance specialist. Because now, it may mean the difference between securing finance for your investment property purchase and missing out.

We’ve spent almost two decades helping investors purchase property all over Australia. We can help you too.

Who are we? Who is MMO?

MO’R Mortgage Options (MMO) is a family team of mortgage brokers.

Our story starts more than two decades ago, when Founder Michael O’Reilly began buying and selling residential property. Michael conducted EXTENSIVE research when exploring his finance options because he didn’t want to pay a single cent more than he had to. But after personally speaking with numerous lenders, Michael discovered he wasn’t always offered the best solution or lending advice.

Michael knew that other investors were accepting these second-rate solutions, because they weren’t aware of what else was available. he wanted to share what he’d learnt with other investors, so they too could create strong financial foundations for their families. Michael opened the doors to MMO in July 2000, to do exactly that.

Since that day, Michael has helped thousands of clients create wealth through property – families we continue to assist today. And just like a good recipe, over the last 20 odd years, the technical know-how, lender knowledge and investment lending strategies have been passed down to the next generation with Michael’s sons Daniel and Brendan and daughter Kathryn, today leading our growing team of mortgage brokers.

Maximise your returns by financing your property portfolio the right way.

We can help.

Who are we? Who is MMO?

MO’R Mortgage Options (MMO) is a family team of mortgage brokers.

Our story starts more than two decades ago, when Founder Michael O’Reilly began buying and selling residential property. Michael conducted EXTENSIVE research when exploring his finance options because he didn’t want to pay a single cent more than he had to. But after personally speaking with numerous lenders, Michael discovered he wasn’t always offered the best solution or lending advice.

Michael knew that other investors were accepting these second-rate solutions, because they weren’t aware of what else was available. he wanted to share what he’d learnt with other investors, so they too could create strong financial foundations for their families. Michael opened the doors to MMO in July 2000, to do exactly that.

Since that day, Michael has helped thousands of clients create wealth through property – families we continue to assist today. And just like a good recipe, over the last 20 odd years, the technical know-how, lender knowledge and investment lending strategies have been passed down to the next generation with Michael’s sons Daniel and Brendan and daughter Kathryn, today leading our growing team of mortgage brokers.

Maximise your returns by financing your property portfolio the right way.

We can help.

What do you get when you work with us?

Tailored borrowing strategy

You can’t just take a strategy you’ve read about in a property investment magazine and blindly implement it. The best strategy for you will depend on your: financial situation (are you stronger from an income vs asset perspective?); future goals (what are your plans for your owner-occupied property); and your timeline (when did you start investing?). Building wealth through property requires a sound borrowing strategy, regular review and strong execution. Work with us and you get all three.

Bespoke lending advice

We’ll show you how to structure investment loans to achieve your objectives and then we’ll help you execute. Sometimes this means working with particular lenders to take advantage of niche borrowing opportunities. Other times, it means diversifying loans across lenders to maximise your borrowing capacity. Our recommendations always consider your longer-term plans as well as taxation implications – which often means working closely with your accountant.

Higher returns from your portfolio

Stop voluntarily paying more interest on your investment loans than you have to. Not only will we ensure you’ve got the right loan, but we’ll negotiate the best interest rate on your behalf. More often than not, a few tweaks to your existing loan structure can have a significant impact on your bottom line. Talk to us to find out what this could mean for you.

Fast turn-around (so you won’t miss out on that property)

The secret to getting your loan approved quickly is knowing exactly how each lender wants an application to be presented. When you choose a mortgage broker who has been working with lenders for almost two decades – a team with intricate knowledge of the internal processing systems of Australia’s largest (and smallest) lenders – you can be sure your investment loan application will be presented in *just* the right way to get it approved fast.

A personal Project Manager

You’ll have someone managing the entire process for you. This means we: tailor a borrowing strategy, prepare the paperwork, package up your application, liaise with the lender for a fast approval, liaise with the agent and work closely with your solicitor. You’ll have someone working for you behind the scenes to ensure everything happens according to your timeframe (which may include settling your investment purchase within a particular tax year).

As much (or as little) analysis as you like

If you like charts and tables and comparison analysis before making a decision, that’s what you’ll get. But if you’re more of a ‘big picture’ person and prefer structural diagrams instead, then that’s what you’ll get. YOU call the shots, not the other way around. You’ll have everything you need to be confident the lending strategy we’re recommending really is the best course of action.

Round-the-clock Support

Some lenders process applications around the clock, meaning questions can be asked about your application outside of business hours and on weekends. It’s our job to handle these queries, whenever they’re asked. The same goes for your questions. Ask us anything and we’ll always do our best to respond quickly and comprehensively.

Support from an entire team

It’s frustrating when your question goes unanswered or progress seems to stop, “because Jimmy’s away and no-one else can help you.” When you work with an individual broker at MMO, you get the support of our entire team – there’s always someone who can help you. Client feedback told us this was important. So many years ago, we restructured our business accordingly. It’s also the reason why many of our client reviews mention more than one person – we work in small teams to provide you with the best service possible.

What do you get when you work with us?

Tailored borrowing strategy

You can’t just take a strategy you’ve read about in a property investment magazine and blindly implement it. The best strategy for you will depend on your: financial situation (are you stronger from an income vs asset perspective?); future goals (including plans for your owner-occupied property); and your timeline (when did you start investing?) Building wealth through property requires a sound borrowing strategy, regular review and strong execution. Work with us and you get all three.

Bespoke lending advice

We’ll show you how to structure investment loans to achieve your objectives and then we’ll help you execute. Sometimes this means working with particular lenders to take advantage of niche borrowing opportunities. Other times, it means diversifying loans across lenders to maximise your borrowing capacity. Our recommendations always consider your longer-term plans as well as taxation implications – which often means working closely with your accountant.

Higher returns from your portfolio

Stop voluntarily paying more interest on your investment loans than you have to. Not only will we ensure you’ve got the right loan, but we’ll negotiate the best interest rate on your behalf. More often than not, a few tweaks to your existing loan structure can have a significant impact on your bottom line. Talk to us to find out what this could mean for you.

Fast turn-around (so you won’t miss out on that property)

The secret to getting your loan approved quickly is knowing exactly how each lender wants an application to be presented. When you choose a mortgage broker who has been working with lenders for almost two decades – a team with intricate knowledge of the internal processing systems of Australia’s largest (and smallest) lenders – you can be sure your investment loan application will be presented in *just* the right way to get it approved fast.

A personal Project Manager

You’ll have someone managing the entire process for you. This means we: tailor a borrowing strategy, prepare the paperwork, package up your application, liaise with the lender for a fast approval, liaise with the agent and work closely with your solicitor. You’ll have someone working for you behind the scenes to ensure everything happens according to your timeframe (which may include settling your investment purchase within a particular tax year).

As much (or as little) analysis as you like

If you like charts and tables and comparison analysis before making a decision, that’s what you’ll get. But if you’re more of a ‘big picture’ person and prefer structural diagrams instead, then that’s what you’ll get. YOU call the shots, not the other way around. You’ll have everything you need to be confident the lending strategy we’re recommending really is the best course of action.

Round-the-clock Support

Some lenders process applications around the clock, meaning questions can be asked about your application outside of business hours and on weekends. It’s our job to handle these queries, whenever they’re asked. The same goes for your questions. Ask us anything and we’ll always do our best to respond quickly and comprehensively.

Support from an entire team

It’s frustrating when your questions go unanswered or progress seems to stop, “because Jimmy’s away and no-one else can help you.” When you work with an individual broker at MMO, you get the support of our entire team – there’s always someone who can help you. Client feedback told us this was important. So many years ago, we restructured our business accordingly. It’s also the reason why so many of our client reviews mention more than one person – we work in small teams to provide you with the best service possible.

Let’s hear from some of our clients…

Exceptional experience with Brendan O’Reilly. Brendan was able to take a lot of information I shared with him about my current situation and was capable of pulling together an incredible restructure package and get it done with ease.

Read MoreMy husband and I have dealt with Daniel from MO’R Mortgage Options for over five years now and couldn’t recommend a more exceptional mortgage broker.

Read MoreMany thanks to Greg and the team for their great assistance with the purchase of my new investment property.

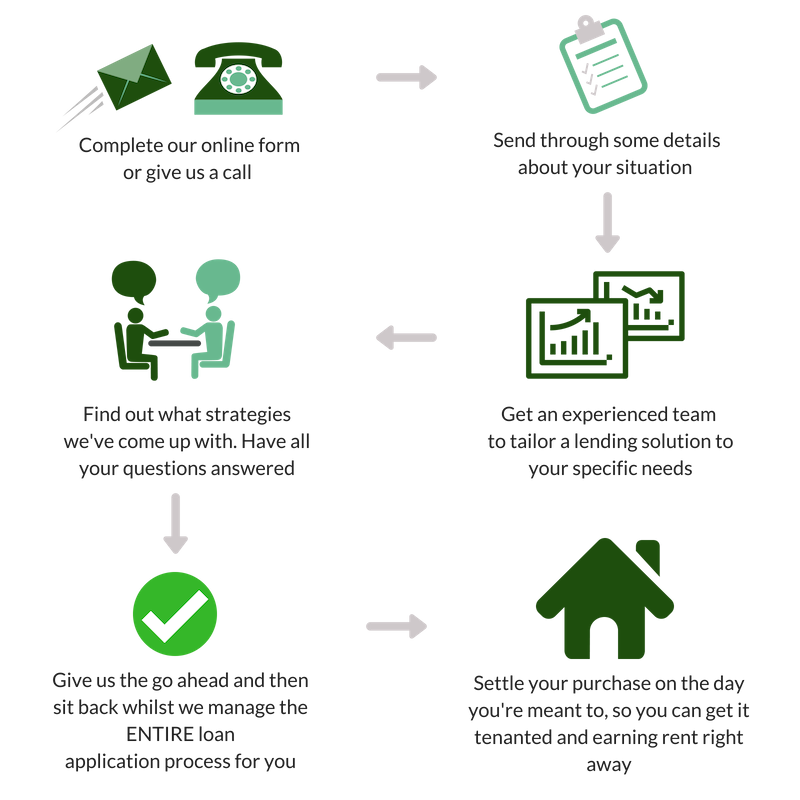

Read MoreWhat does working with us look like?

You’ll get immediate access to:

How much does our Property Investment Service cost?

If you’ve never worked with a broker before, you may not know our service is provided to you completely free of charge.

Yep, that’s right. You pay us nothing.

We do not charge for our service. This is not a fee-for-service transaction.

We’ll tailor an investment lending strategy specifically for you. We’ll then help you execute the strategy by managing the entire loan application process. Because we’re serious about helping you achieve the returns you’re looking for, we’ll also check-in on you long after your loan has settled to see if there’s anything we can do to save you even more money.

Spend the next ten years benefiting from our knowledge, industry experience and technical know-how without it costing you a single cent.

In fact, work with us and we’re confident we’ll help you increase your returns.

— So how do we get paid then? —

Mortgage brokers are paid directly by the lender, if and when they help you secure a loan.

We’re completely transparent and upfront about this and will advise how much this could be when we talk to you about your finance options.

A mortgage broker can access the same loan products and access the same home loan rates you could obtain directly from a lender. We can negotiate additional rate discounts on your behalf, but the real benefit is in helping you structure your investment loans properly to achieve your objectives.

Work with us and you’ll also receive these additional benefits…

Here are more reasons to work with us:

We can share buying tips

Don’t pay more for your investment property than you have to. We can reveal tips on how to negotiate the best purchase price, share tools used by investors to help determine the value of a property; provide auction support; PLUS share the lessons we’ve learnt over the last two decades helping clients purchase residential property all over Australia.

Regular loan reviews

It’s our mission to ensure that no MMO client pays more for their loans than necessary. This means we’ll touch base with you regularly to review your investment loans and check they’re still competitive given the current market. This is a completely free service we provide to existing clients. And if you’re ever concerned about your loans – or something doesn’t seem right – we’re only an email away.

Access to our growing Resource Library

As a client, you’ll have access to our growing library of industry-related articles, e-books, loan scenario case-studies and other resources. You will also receive the Special Reports we generate for the Canberra Property Market – revealing suburb trends, property price growth patterns, changes in land values and trends in housing affordability. We want to provide you with the information you need to make confident, informed decisions about your investment portfolio.

Work with Canberra’s best property service providers

Over the years, we’ve worked with just about everyone in town. Based on this experience and more importantly, feedback from our clients, we’ve created a “Best of the Best” List of Canberra’s best real estate agents, property managers, solicitors, accountants, financial planners, building inspectors and quantity surveyors. If you need help with any aspect of managing your property portfolio, we can put you in touch with the right people.

Receive Regular Updates

Every few months we deliver a summary of what has been happening in the industry, provide commentary on market developments and/or potential interest rate movements straight to your inbox. You already get a tonne of emails, but our Updates are short and to the point, with the sole purpose of alerting you to anything that may affect you and your property portfolio (so you can do something about it if necessary).

Join our Client Referral Program

Take the opportunity to be rewarded with gifts and vouchers from some of Canberra’s best service providers and restaurants, simply by telling your family and friends about your experience working with us.

More reasons to work with us:

We can share buying tips

Don’t pay more for your investment property than you have to. We can reveal tips on how to negotiate the best purchase price; share tools used by investors to help determine the value of a property; provide auction support; PLUS share the lessons we’ve learnt over the last two decades helping clients purchase property all over Australia.

Regular home loan reviews

It’s our mission to ensure that no MMO client pays more for their loans than necessary. This means we’ll touch base with you regularly to review your investment loans and check they’re still competitive given the current market. This is a completely free service we provide to existing clients. And if you’re ever concerned about your loans – or something doesn’t quite seem right – we’re only an email away.

Access to our growing Resource Library

As a client, you’ll have access to our growing library of industry-related articles, e-books, loan scenario case-studies and other resources . You will also receive the Special Reports we generate for the Canberra Property Market – revealing suburb trends, property price growth patterns, changes in land values and trends in housing affordability. We want to provide you with the information you need to make confident, informed decisions about your investment portfolio.

Work with Canberra’s best property service providers

Over the years, we’ve worked with just about everyone in town. Based on this experience and more importantly, feedback from our clients, we’ve created a “Best of the Best” List of Canberra’s best real estate agents, property managers, solicitors, accountants, financial planners, building inspectors and quantity surveyors. If you need help with any aspect of managing your property portfolio, we can put you in touch with the right people.

Receive Regular Updates

Every few months we deliver a summary of what has been happening in the industry, provide commentary on market developments and/or potential interest rate movements straight to your inbox. You already get a tonne of emails, but our Updates are short and to the point, with the sole purpose of alerting you to anything that may affect you and your property portfolio (so you can do something about it if necessary).

Join our Client Referral Program

Take the opportunity to be rewarded with gifts and vouchers from some of Canberra’s best service providers and restaurants – simply by recommending us to your family and friends.

What do other clients say about working with us?

Gemma and I have had the opportunity to deal with Brendan and Michael for two different loans now and both times it has been an absolute pleasure.

Read MoreThird time using MO’R Mortgage Options and couldn’t recommend the team more. 30 day settlement from our recent purchase and the team had all the documents ready to go.

Read MoreMO’R Mortgage Options have changed our lives, a fantastic team that have every clients best interest at heart.

Read MoreFrequently Asked Questions

I’ve never used a mortgage broker before, why can’t I just talk to my bank?

You can – you can just talk to your bank.

But when you work with us, you’re working with a team who KNOW investment finance. A team of brokers who know and love property – and own investment property themselves. You’re working with an industry recognised team who is serious about helping you over the long term.

We can show you how to maximise your borrowing capacity to make that investment purchase. We show you how to maximse your returns using specific loan features and structuring techniques that save you interest. (Not suprisingly, these are strategies lenders aren’t always so forthcoming with.)

Can I get a better deal if I go through a mortgage broker?

Mortgage brokers can access exactly the same loan products as what’s available if you walked straight into your local branch.

We can negotiate additional rate discounts on your behalf. But the real value is in helping you find the right loan from the right lender and then structuring your investment loans to help you maximise returns from your investment portfolio.

Plus we also handle everything for you. We: do the calculations; present you with the best options; package up your loan application; chase the lender; arrange all the paperwork; check loan contracts before you sign them; liaise with your solicitor, accountant and real estate agent and we’ll let you know where things are up to every step of the way.

When you consider all the extra benefits you receive (at no cost!) by working with us, it’s easy to see why growing numbers of property investors are choosing to work with mortgage brokers.

Are you sure there are no hidden fees to use your services?

There are no fees for our service.

We do NOT charge any fees to calculate your Borrowing Capacity, analyse your options, tailor a loan strategy to meet your investment objectives and we do not charge for our credit advice.

Likewise, we do NOT charge fees to lodge your application, manage the entire process from start to finish. Nor do we charge fees for any of the ongoing services we provide (i.e. our post-settlement check-up, helping you change/ switch your loan later on, regular home loan reviews).

If we arrange a loan for you, we receive a payment directly from the lender. We’re completely transparent and upfront about this and will discuss how this works in detail when we talk to you about your loan options.

I’d prefer to meet before sending you any information about my personal situation. Can I just book an appointment?

We completely understand it may seem like we’re asking for a lot of information, right at the start. The thing is though, we cannot provide the best service (or accurate credit advice) without detailed information about your existing situation. Lenders are changing their policies all the time and without a thorough understanding of your position, we’re just guessing what might be possible from an investment lending perspective.

If you want to have a general chat before sending any documentation through, please call us on 02 6286 6501.

We know there may be others who don’t ask for much information initially – and that’s completely up to them. We want to deliver the best service possible without wasting your time. We’re continually refining our processes based on client feedback, we’re confident our current systems help us to do exactly that. (Our 5 Star Facebook and Google Review Rating confirms this too.)

How long after I talk to you can I make an offer on an investment property?

This depends on a few factors. Specific times (i.e. the lead up to Christmas and end of financial year) can be busier for lenders, so sometimes things can take a little longer to be processed on their end.

The faster you provide your supporting documentation, the faster you’ll get a result.

If you’re thinking of buying an investment property soon, it’s ALWAYS better to get your finance in place well before you need it. Especially if restructuring of your portfolio is required or you’re hoping to release equity to assist with your new purchase.

I’m an investor but not currently looking to buy property, can you still help me?

Absolutely we can! If there’s a way to save money on your existing investment loans, we’ll find it!

We would love to review your existing loan portfolio to ensure it’s helping you achieve your objectives. And if it’s not, we can suggest a few changes to help you get back on track.

Are you currently taking on more Property Investor clients?

Being a small family team of mortgage brokers, there’s a limit to the number of new clients we can take on each month. This suits us perfectly because we’re not interested in being the biggest brokerage in town. Our priority has always been (and still is!) to deliver quality service to quality clients.

We want to help investors who are serious about building wealth through property.

If this sounds like you, we’d love to help!

Maximise your investment returns with the right borrowing strategy.

Click on the button below to get started.

We’ll ask for some contact details and be in touch shortly.