As of 1 July, if you’re a first home owner purchasing in the ACT, the first home owners grant of 7K will no longer be available.

As of 1 July, if you’re a first home owner purchasing in the ACT, the first home owners grant of 7K will no longer be available.

However, the good news is that as a first home buyer with a household annual income of less than $160,000,* providing you satisfy eligibility criteria, you will not be required to pay any stamp duty (or ‘conveyance duty’ as it’s referred to by the ACT Government) on your purchase.

Up until now, first home buyer stamp duty concessions have been offered on new properties, but only up to a purchase price of $607,000.

Changes to the home buyer concessions from 1 July will extend first home buyer stamp duty concessions to established properties, new properties and vacant land – with no maximum price threshold on the property purchased.

Stamp Duty Changes from 1 July

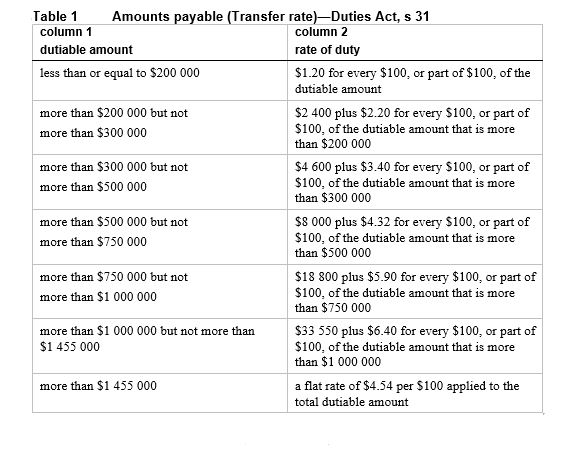

The announced changes to stamp duty payable in the ACT from 1 July 2019 are shown in the table below.

Source: Taxation Administration (Amounts Payable – Duty) Determination 2019 (No 1)

As an example, let’s just say you’re looking to purchase your first home at a price of $610,000.

Stamp duty payable for a $610,000 purchase of an established property post 1 July 2019, is estimated at $12,752 (assuming no first home buyer concessions).

Meaning that the first home buyer concessions coming into effect tomorrow, represent a significant saving.

We won’t be comparing the concessions available pre 1 July and post 1 July because it’s now largely irrelevant. (We have had lots of conversations with individual borrowers about this recently though, helping them to decide the best buying option given their personal situation, buying price point and eligibility for ‘old’ and ‘new’ first home buyer concessions).

All that matters now, is whether the introduction of these new concessions can help you to buy your first home sooner than you thought was possible.

If you want to find out if you’re ready (or nearly ready) to buy your first home, get in touch with our team.

* The total gross income threshold increases slightly in accordance with the number of dependent children you have.

______________________________________________________________________________________________

For more info: