If you’re a soon-to-be first home buyer, you’ve no doubt heard about the First Home Loan Deposit Scheme (FHLDS) and how it can help buyers get into the market.

If you’re a soon-to-be first home buyer, you’ve no doubt heard about the First Home Loan Deposit Scheme (FHLDS) and how it can help buyers get into the market.

We’ve assisted some of our clients with the FHLDS already, but since it’s only available to 10,000 buyers across Australia, there are other borrowing options available to you if you’re a little short of that elusive 20% deposit.

In addition to these, as a first home buyer in the ACT, you may also be eligible for the following stamp duty (also known as conveyance duty) concessions.

Stamp Duty (also known as Conveyance Duty) Waiver

When you buy a property in the ACT, you need to pay stamp duty – which can be quite a significant amount depending on the purchase price.

From 1 July 2019 however, the ACT government offered to waive stamp duty for first home buyers who met the following eligibility requirements:

- Buyers need to be over 18 years old;

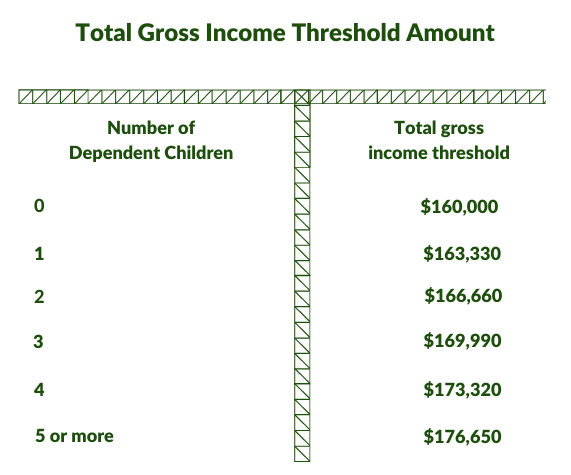

- The total gross income of all buyers (including partners) over the full financial year before the purchase date, must not be greater than the prescribed income thresholds noted in the table below;

- All buyers (including partners) must not have owned other property in the last two years; and

- At least one buyer must live in the home continuously for at least one year, starting within 12 months of settlement or completion of construction.

Unlike previous first home buyer concessions, the stamp duty waiver applies to vacant residential land, new and established homes and properties sold at any price.

Find out more about eligibility requirements, how to have concessions applied and what documentation may be required here.

How does a Waiver of Stamp Duty help you as a first home buyer?

Let’s look at an example.

Stamp duty payable on a $500,000 property in the ACT is calculated at $11,400.

If you’re a first home buyer eligible for a Stamp Duty Waiver, you do not pay this stamp duty amount.

This means the cash contribution required to complete your purchase has just reduced by $11,400 (i.e. you may not need to save as much cash before you’re ready to buy).

Alternatively, you might be able to purchase with a smaller loan amount – therefore saving interest over the long term and perhaps even saving you from Lenders Mortgage Insurance.

Stamp Duty Deferral

If you don’t meet eligibility requirements to waive stamp duty altogether, deferring Stamp Duty is another option. This is providing you’re buying an ACT property for less than $750,000.

Having your Stamp Duty Deferred allows you to pay it back over 10 years from the transaction date (unless you sell your property within 10 years, at which point the deferred stamp duty amount becomes payable.) Also something to keep in mind is that you need to make your first stamp duty repayment within 5 years from buying the property.

Interest accrues on the deferred stamp duty amount and at the date of this post, the interest rate applicable is 0.91%.

You can find interest rates applicable on Stamp Duty deferrals here and more about the stamp duty deferral process here.

How does Deferring Stamp Duty help you as a first home buyer?

If we go back to the example above, having your stamp duty deferred means you don’t have to pay the stamp duty amount right away. Which means your upfront purchasing costs are lower – which is good news if you’ve been struggling to save enough to purchase a property.

If you’re reading this as a first home buyer and feel even more confused about your options and what concessions you may be eligible for, please reach out to us. That’s why we’re here!

Buying your first home doesn’t need to be a stressful process. You just need to have the right team to help you navigate the process.

Find out more about our service for First Home Buyers here.