Given the recent talk about interest rates (and a round of fixed rate increases in October), we thought it was time to share an updated post on rates.

Please note analysis and commentary on interest rates provided here is based on data available as at 28 October 2021.

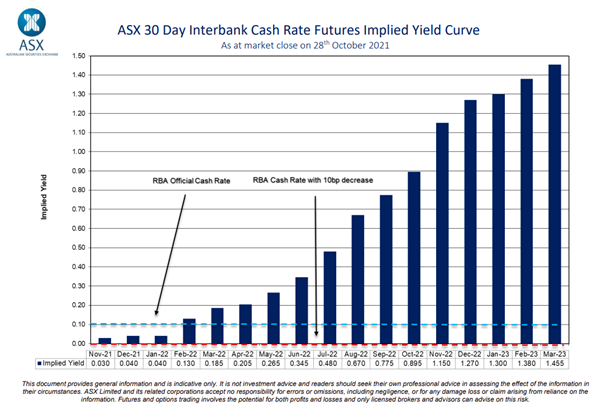

Cash Rate Futures Yield Curve

The Cash Rate Futures Yield Curve is a tool we use to provide insight into how the market expects interest rates to behave. More specifically, it reveals market expectations of RBA Cash Rate movements over the next 18 months.

The curve does not always accurately predict the cash rate (nor the exact time the RBA decides to change it). However, it can be a useful tool to examine – especially if you look out for how market expectations change over time.

The Yield Curve at 28 October 2021 as per below:

The RBA Board has kept the cash rate at 0.1 per cent since November 2020, and it’s expected to remain low for some time. In fact, trading as at 28 October shows 75% market expectation of an interest rate decrease to 0.00% at the RBA’s November Board meeting.

What does this mean for lender interest rates?

The above suggests that the cash rate is going to remain low for quite some time yet. And whilst a change in the cash rate is not necessarily reflected with an equal change in variable rates offered by lenders, RBA rate projections can be used as a guide to predict rate movements.

This only tells one side of the story though, because as we’ve seen over the past few weeks, fixed rates offered by lenders often move independently. We’ve seen a whole host of lenders make changes to their fixed rates recently, which may play into your decision as to which loan is going to be the most suitable for you, and/or what portion to your borrowings you should have variable vs fixed.

So, which loan should *you* go for – fixed or variable?

Since we can never be certain what rates will do (or when) – and we’ll never know for certain whether a fixed rate loan has saved you interest until AFTER the fixed rate period has expired, we always suggest you take a ‘bigger picture’ approach when weighing up your options.

Sure, you want to consider the interest you potentially stand to save when compared to the current variable rates on offer. However, there’s a little more you need to consider as part of the fixed vs variable decision.

Things like:

- What are your longer term plans for the property?

- How much do you expect to save over the next few years?

- Is there a chance you’ll receive a lump sum cash payment and have a large amount to cash available to quickly pay down your loan?

If you would like some help to determine which option is going to suit you best, let us know.

We’re here to help!

You can read more here:

https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf

This post was published 28 October, 2021. This information here is provided for general purposes only and does not constitute financial advice. Before any specific lending or loan structure is recommended to you personally, a Preliminary Assessment would need to be conducted to ensure any credit advice provided by MO’R Mortgage Options Pty Ltd is not unsuitable for your specific financial situation.