Citing ‘regulatory changes on capital requirements’ as the reason for the increase, over the last week we have seen most of the major lenders announce increases to their interest rates, outside of any RBA rate change.

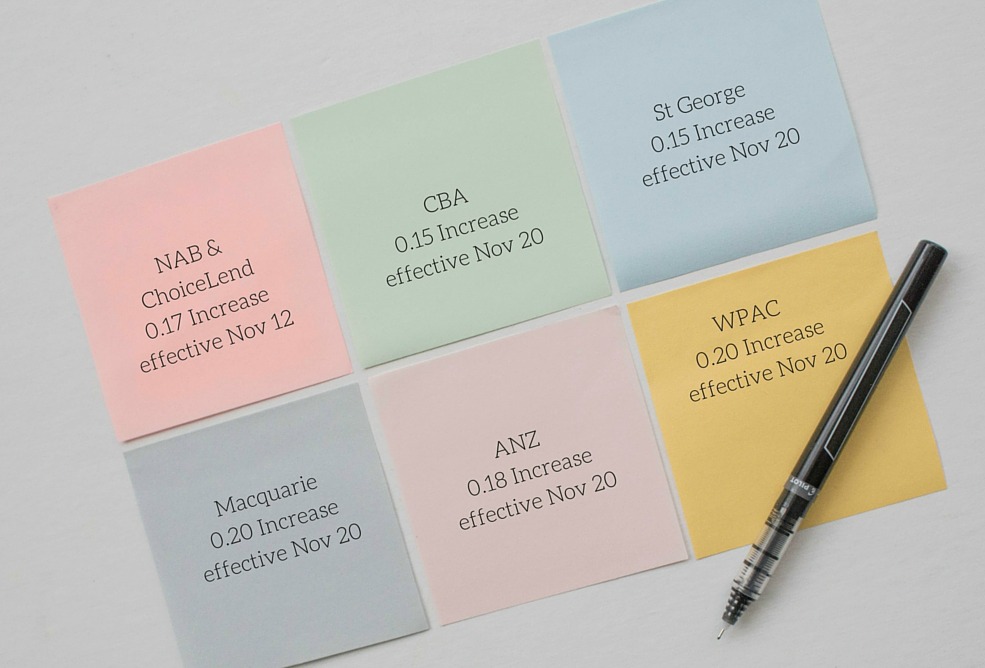

Below summarises the changes that have been announced by some of the main lenders, and when the new rate will take effect.

Please note that rate increases announced this time will apply to both owner occupier and investor loans.

Whilst ING has not announced any interest rate movements as of yet, we do expect them to rise in line with the others.

Commentators believe this may be the catalyst to put a brake on rising house prices.

It will be interesting to see if this has any effect on the RBA’s November cash rate decision.

If you’re worried about how these changes may affect you and your loan repayments, give us a call.

Despite the announced rate increases, some lenders are still open to providing existing borrowers with discounts off their existing rates.

Getting your lender to approve a pricing discount will depend on your loan size and personal situation and often comes down to asking the right people in the right way. It’s something we can assist you with, if we haven’t already.

*Post Update – ME has announced a rate increase of 0.20 effective Nov 20, 2015*

*Post Update – Suncorp has announced a rate increase of 0.16 effective Nov 20, 2015*

*Post Update – AMP has announced a rate increase of 0.18 effective Nov 20, 2015*