Anyone thinking about locking into fixed rate loan will generally spend a little time considering the future movement of interest rates.

Here we share some tools that can provide some insight into what interest rates are expected to do over the short-medium term.

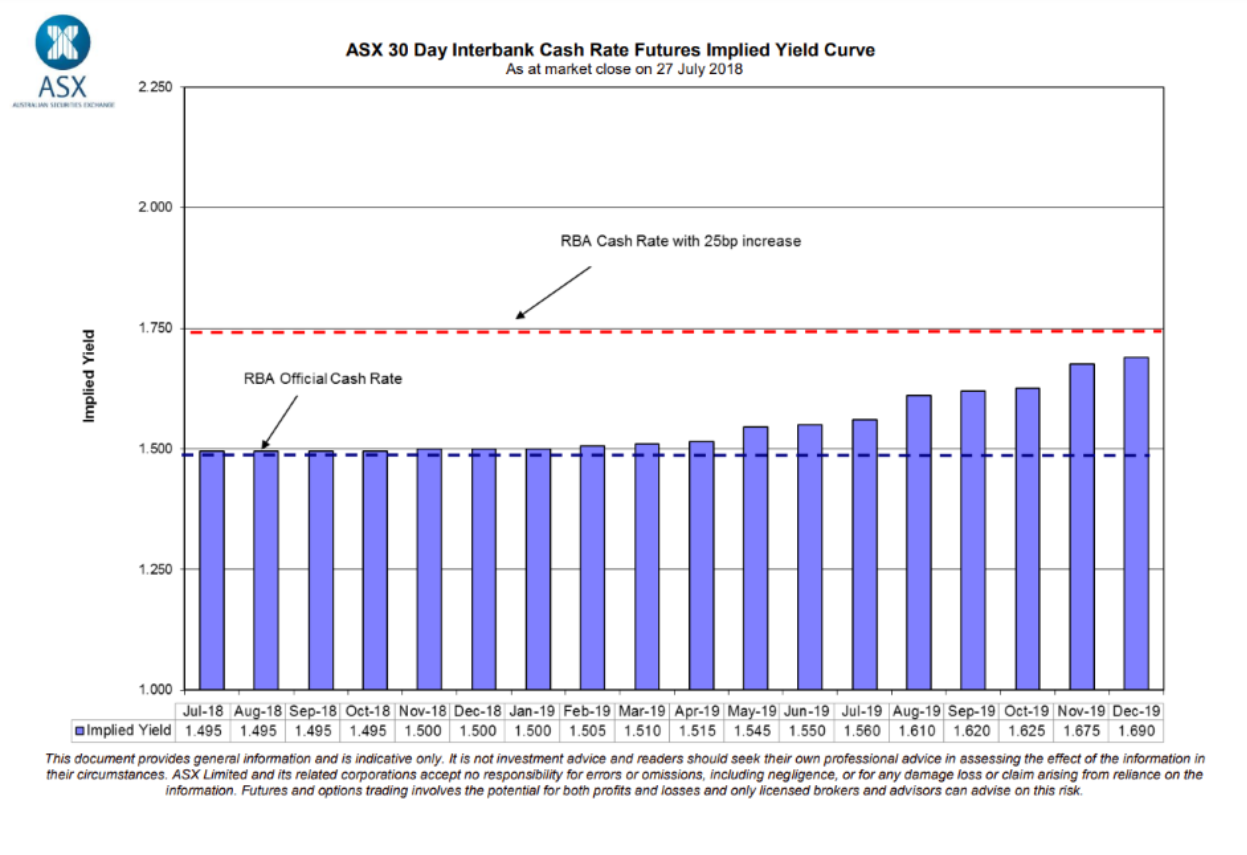

Cash Rate Futures Yield Curve

The Cash Rate Futures Yield Curve shows how the market expects interest rates (or more specifically the RBA cash rate) to move over the short-medium term.

The curve does not 100% accurately predict how things play out, but it’s helpful to show what the market expects to happen with regards to interest rates. It’s also interesting to watch how these market expectations change over time.

For example, the Cash Rate Futures Yield Curve at February 2018 reflected market expectation of a cash rate rise half way through 2019.

However, the Yield Curve as at 27 July 2018 below suggests rates are more likely to increase towards the end of 2019, based on market expectation.

You can find the ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve here.

If we look at the Minutes from the last few RBA Board meetings, there are clues as to why the market has changed the timing of an expected cash rate increase.

Growth has improved but it’s below the RBA expectations of 3.25 per cent. Wages and inflation remain low. Plus, there’s been a slowdown with Sydney and Melbourne property prices.

The other factor that comes into play is the tightening of lending standards. Regulators have toughened the lending requirements for the banks. This has effectively slowed lending – particularly investment lending – without the RBA making any change to the cash rate.

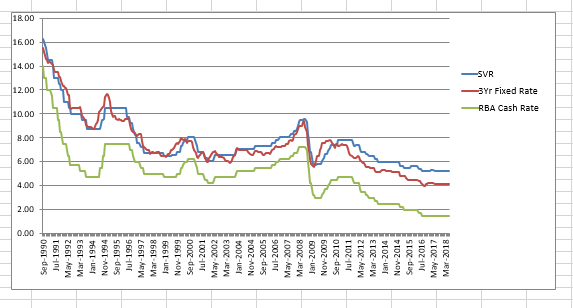

Comparing the Standard Variable Rate, 3YR Fixed Rate and RBA Cash Rate

Charting historical movements of the Standard Variable Rate (SVR) vs 3Yr Fixed Rate vs RBA Cash Rate to look for trends, can also be useful. (RBA data sets used to create this chart can be found here.)

We can see from the chart that historically, movement of the 3Yr Fixed rate has preceded a corresponding movement of the SVR.

For example, when the 3yr Fixed Rate has risen above the SVR, we can see that the SVR has followed – albeit with lag time. At these particular points on the chart, you may have done well with a fixed rate loan.

Conversely, on occasions where the 3yr Fixed Rate changed direction and moved below the SVR, the SVR has followed – again with a lag time. In these instances, you may have been better off with a variable rate loan.

The chart shows no overlap of the 3Yr Fixed Rate and SVR plot lines in recent times though, making it hard to use these historical patterns to predict future rate movements right now. It’s also important to note that using historical data (and applying patterns borne from historical data sets) comes with its own limitations. However, it’s a tool we’ll continue to look at as rates continue to change.

What does this mean for you and your loan?

The analysis above suggests that an increase to the cash rate is unlikely over the short term.

However, this DOES NOT mean your current home loan rate will remain the same.

Recently we’ve seen some lenders increase home loan rates independent of any change to the RBA cash rate and it’s likely other lenders may do the same. (You can read about the rate increases and reasons for these changes here.)

Does this mean you should you fix your variable rate loan?

In an ideal world, we would all like to lock into a fixed rate loan at exactly the right time to save a whole lot of interest.

But not even the experts know exactly what interest rates are going to do. This makes switching at exactly the right time – for exactly the right fixed term – quite challenging!

This is why we always suggest taking a look at the bigger picture and considering your fixed vs variable rate decision, as part of a broader borrowing strategy.

For example:

- Will a fixed rate loan help to diversify your loan portfolio (and protect against variable rate rises)?

- Will a fixed rate loan help/ hinder your plans to grow/ consolidate your property portfolio?

- Will a fixed rate loan help you better manage your outgoings?

There are specific situations when a fixed rate loan is beneficial (you can find them here) and other situations when a variable rate loan is more suitable (we outline them here).

Plus, there’s always the option of having the best of both worlds and splitting your loan into part variable and part fixed. That way, you get certainty with budgeting on the fixed portion and can take advantage of interest-saving opportunities on your variable portion (by using an offset account and/or making additional repayments into the loan).

If you want to discuss your personal situation or need help making changes to your existing loan, we’re here to help!

You can read more here:

https://www.rba.gov.au/media-releases/

http://www.rba.gov.au/statistics/tables/#money-credit

https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf

This post was published 30 July, 2018. This information here is provided for general purposes only and does not constitute financial advice. Before any specific lending or loan structure is recommended to you personally, a thorough Preliminary Assessment would need to be conducted to ensure any credit advice provided by MO’R Mortgage Options is not unsuitable for your specific financial situation.