At its meeting today, the RBA Board decided to reduce the cash rate by 25 basis points to 0.75 per cent.

Here are some of Philip Lowe’s commentary surrounding the decision:

The Australian economy expanded by 1.4 per cent over the year to the June quarter, which was a weaker-than-expected outcome. A gentle turning point, however, appears to have been reached with economic growth a little higher over the first half of this year than over the second half of 2018. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector should all support growth. The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending.

….

There are further signs of a turnaround in established housing markets, especially in Sydney and Melbourne. In contrast, new dwelling activity has weakened and growth in housing credit remains low. Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

The Board took the decision to lower interest rates further today to support employment and income growth and to provide greater confidence that inflation will be consistent with the medium-term target. The economy still has spare capacity and lower interest rates will help make inroads into that. The Board also took account of the forces leading to the trend to lower interest rates globally and the effects this trend is having on the Australian economy and inflation outcomes.

….

If we’ve spoken with you over the last week or so, you’d already already know that this announcement was not unexpected, given the strengthening market expectations surrounding a rate decrease.

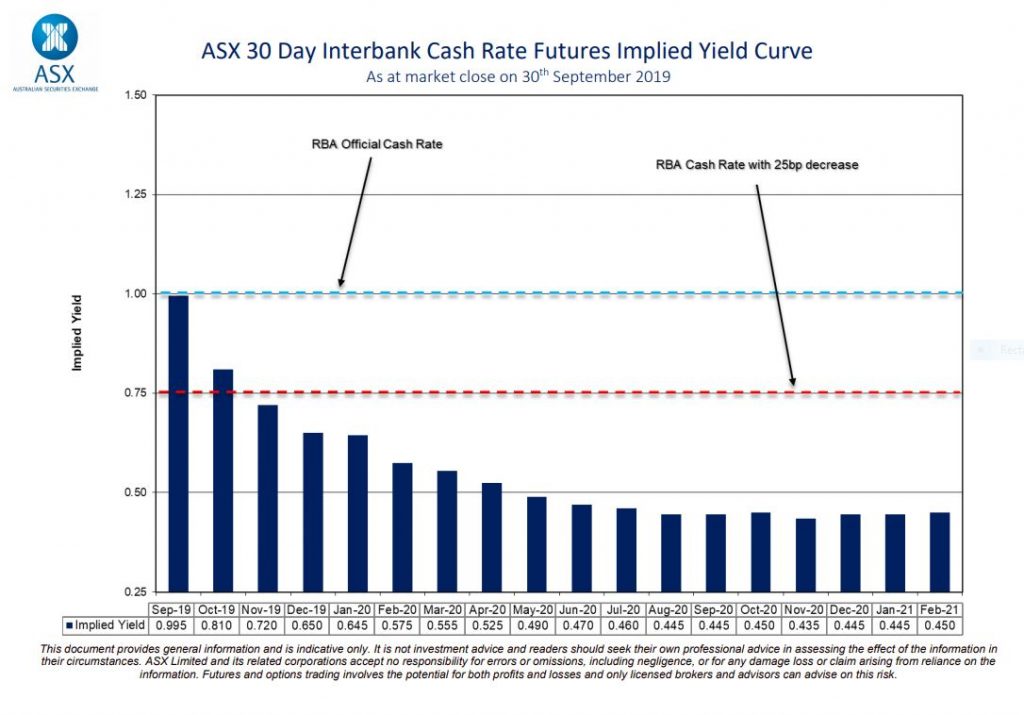

As we talked about here, the Cash Rate Futures Yield Curve is a tool that provides insight around the market expectations of future interest rate movements. Specifically, it reveals market expectations surrounding RBA Cash Rate movements.

And as of yesterday 30 Sept, the market was pretty confident that the RBA would cut the cash rate at their October meeting.

In fact, as at 30 September, there was a 78% market expectation of an interest rate decrease to 0.75% at today’s October RBA Board Meeting.

Which is exactly what’s played out.

What does this mean for interest rates offered by lenders?

We don’t know… yet.

As we all know, a fall in the cash rate DOES NOT necessary mean lenders will pass on a rate cut. Nor does it mean a rate cut will be passed on in full by all lenders.

If lending rates do fall – just like last time – we may see lenders pass on different rate cuts to different types of loans.

Once the majority of lenders have officially responded, we’ll share their rate changes on our blog here and also on Facebook.

Make sure you’re following along on Facebook here to see our updates.

You can read more here:

https://www.rba.gov.au/media-releases/

https://www.asx.com.au/prices/targetratetracker.htm

https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf

This post was published 1 October, 2019.