Cross collateralisation is a strategy used by lenders to tie up more of your security than they actually need – for their own benefit.

Here we compare stand alone loans vs cross collateralisation to help you decide which is most suitable for you.

A stand alone loan structure is when one loan is secured by one property. Cross collateralisation is when one loan is secured by multiple properties.

An example

Your existing home is worth $550K and owner occupier loan is $250K. You’d like to buy an investment property for $400K and require new borrowings of $420K to cover the purchase price and costs.

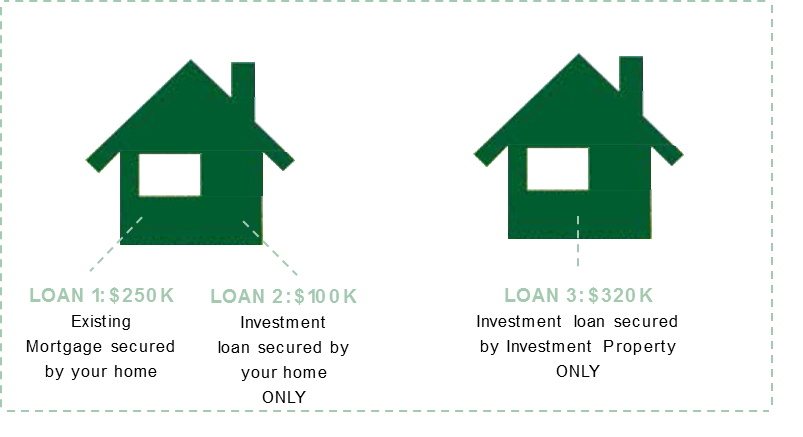

Using a stand alone loan structure in Figure 1, a new loan of $320K could be secured solely by your new investment property (80% LVR to avoid Lenders Mortgage Insurance). Another loan of $100K could be secured solely by your existing home to provide sufficient funds for the purchase.

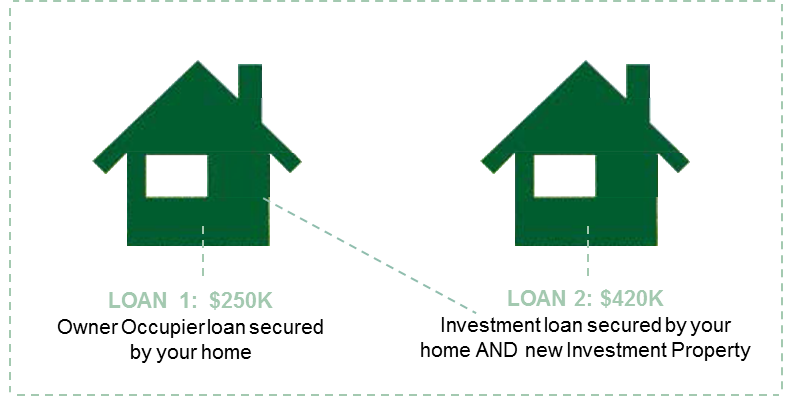

Alternatively, using a cross collateralised loans in Figure 2, a new investment loan of $420K could be secured by your existing home AND your new investment property.

Figure 1 – Stand Alone Loans

Figure 2 – Cross Collateralised Loan

Since both options will potentially provide $420K tax deductible debt and allow you to purchase the investment property, why should you prefer a stand alone loan structure to a cross collateralised one?

Let’s examine the pros and cons…

Stand Alone loans

| Advantages |

|

| Disadvantages |

|

Cross Collateralised loans

| Advantages |

|

| Disadvantages |

|

*This does not constitute tax advice – you will need to discuss your personal situation with the ATO or your accountant. Prior to our final recommendation in regards to specific loan products, we are required to complete a Preliminary Assessment to ensure a specific product is suitable for your requirements, objectives & financial situation. www.mmo.com.au provides information about what options might be suitable for you but does not in any way provide a final recommendation with regards to specific lenders, specific loan product or loan amounts. Information provided is subject to change at any notice.