It’s a question we get asked quite a lot and the answer will vary, depending on your reasons for wanting to fix.

The primary benefit of a fixed rate loan is that you know exactly what the repayment will be each month. You can budget accurately and feel comfortable knowing that your repayments will not increase with any unexpected rate rises. If these things are important to you, a fixed rate loan can be a good option.

If you’re only considering a fixed rate loan to save interest, it can be tricky to predict the “right time” to lock in. However, there are some tools that can help us to determine what variable rates are likely to do and therefore when might be a good time to fix.

The following charts the RBA Cash Rate, Standard Variable Rate (SVR) and 3yr Fixed Rate over the last 25 years (using indicator lending rates available here from the RBA).

If you apply technical analysis, you could mount an argument that when the 3yr Fixed Rate moves above the SVR line, it’s possibly indicating that the SVR is about to rise (meaning you could do well with a fixed rate). Conversely, when the 3yr Fixed Rate changes direction and moves below the SVR, it could signal that the SVR is about to drop (and you may be better staying variable).

Of course, it’s much easier to pick the right times when you look at historical data!

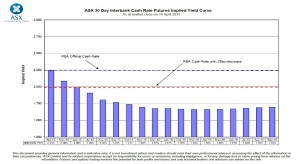

So, let’s look into the future by examining the interbank cash rate futures market. Here, we can see what’s trading at what prices in the future.

Although there is still a bit of ‘crystal balling’ involved, we’ve found it quite useful and reasonably accurate in providing a short/medium term outlook of what rates are expected to do (rather than predicting when rates will drop).

We think that the SVR will go lower, but by how much, how quickly and for how long it will stay low, is the tough question.