Think you’re paying too much for your loan?

(You probably are)

We can change that.

Does this sound familiar?

You don’t like paying more than you have to

You’ve never once offered to pay full price for something on sale. But it’s not so easy to work out you’re paying overs on your home loan. The reality is though, if you’ve been comfortably meeting your loan repayments for a few years now, there’s a good chance that’s exactly what you’re doing.

Reviewing your loans has been ‘on the list’ for a while now, but not really a priority

You understand the importance of reviewing your loans regularly, but life keeps getting in the way. Your salary comes in, the repayment comes out and to be honest, your mortgage is not something you really think about day-to-day. You’re not sure you’re ‘getting ahead’ on your mortgage – but you’re not going backwards either – so you’ve just been content to do nothing.

You don’t necessarily want to switch lenders

There are things that annoy you about your current lender (i.e they increased their rates), but they’re OK for the most part. You like your internet banking. You like your credit card points. You like the way your every-day banking operates. Things are comfortable the way they are. You don’t want to switch lenders (or complicate things) just for the sake of it.

You don’t know where to start

When you tried to check-up on your loan a little while ago, things quickly became complicated. You tried to compare rates, but they differed accordingly to the repayment and loan type. You then tried to compare loan features, but you weren’t sure which ones you actually needed. So rightly or wrongly, you didn’t do anything.

You want to own your home, but you don’t want to change your lifestyle

You’d like to own your home one day and you’re pretty confident you’ll get there eventually. You sometimes think you should be doing more to pay off your home loan faster, but you want to enjoy life too. You want to go out for dinner, take the family on overseas holidays and treat yourselves once in a while. It would be ideal if you could find a way to do both.

You don’t think the hassle is worth it

Collating statements, doing comparisons, chasing up the bank, spending time on hold – reviewing your loans seems like a hassle. The last thing you need is another thing to manage – especially this close to Christmas/ your holiday/ your little one’s birthday/ every-day life. If only you could get someone else to manage the whole process for you…

Does this sound familiar?

You don’t pay more than you need to

You’ve never once offered to pay full price for something on sale. But it’s not so easy to detect when you’re paying overs on your home loan. The reality is though, if you’ve been comfortably meeting your loan repayments for a few years now, there’s a good chance you’re paying more than you need to.

You don’t know where to start

When you tried to check-up on your loan a little while ago, things quickly became complicated. You tried to compare rates, but they differed accordingly to the repayment and loan type. You then tried to compare loan features, but you weren’t sure which ones you actually needed. So rightly or wrongly, you didn’t do anything.

Reviewing your loans has been ‘on the list,’ but not a priority

You understand the importance of reviewing your loans regularly, but life keeps getting in the way. Your salary comes in, the repayment comes out and to be honest, your mortgage is not something you really think about day-to-day. You’re not sure you’re ‘getting ahead’ on your mortgage – but you’re not going backwards either – so you’ve just been content to do nothing.

You want to own your home, but you don’t want to change your Lifestyle

You’d like to own your home one day and you’re pretty confident you’ll get there eventually. You sometimes think you should be doing more to pay off your home loan faster, but you want to enjoy life too. You want to go out for dinner, take the family on overseas holidays and treat yourselves once in a while. It would be ideal if you could find a way to do both.

You might not want to switch lenders

There are things that annoy you about your current lender (i.e they increased their rates), but they’re OK for the most part. You like your internet banking. You like your credit card points. You like the way your every-day banking operates. Things are comfortable the way they are. You don’t want to switch lenders (or complicate things) just for the sake of it.

You’re not sure the hassle will be worth it

Collating statements, doing comparisons, chasing up the bank, spending time on hold – reviewing your loans seems like a hassle. The last thing you need is another thing to manage – especially this close to Christmas/ your holiday/ your little one’s birthday/ every-day life. If only you could get someone else to manage the whole process for you…

It’s ok. We’re here to help.

With so many things calling for your attention, it’s easy to fall into the trap of thinking, “If it ain’t broke, don’t fix it.” It’s human nature to prioritise – and make time for – things that require our urgent attention.

Like replacing the car because the engine decided to die. Or repairing the roof because it leaks every time it rains. Or installing evaporative cooling because you absolutely cannot cope with another Canberra summer.

It’s jobs like these that tend to get your attention because you can immediately see and feel when things aren’t working.

It’s a little harder to identify a defective (or more costly) mortgage, especially if you can afford the *higher-than-they-should-be* repayments.

BUT.. if you really knew how much extra you’re paying in additional interest and/or fees, you might prioritise a home loan review.

For more than two decades, we’ve been helping home owners save money on their existing loans.

We can do the same for you.

Who are we? Who is MMO?

MO’R Mortgage Options (MMO) is a family team of mortgage brokers.

Our story starts more than two decades ago, when Founder Michael O’Reilly took a closer look at what he was paying for his home loan. Michael conducted EXTENSIVE research into his mortgage options because he didn’t want to pay a single cent more than he had to. And after personally speaking with numerous lenders, Michael discovered he wasn’t always offered the best solution or technical lending advice.

Michael knew there was a good chance other borrowers were accepting these second-rate home loan options because they were unaware of what else was available. He wanted to share what he’d learnt with others, so they too could create strong financial foundations for their families. Michael opened the doors to MMO in July 2000, committed to do exactly that.

Since that day, Michael has helped thousands of clients improve their finances, by helping them select better loans – families we continue to assist today. And just like a good recipe, over the last 20 odd years, the financing structures, lender knowledge and technical know-how has been passed down to the next generation with Michael’s sons Daniel and Brendan and daughter Kathryn, today leading our growing team of mortgage brokers.

We do the work. You save the money.

Book a home loan review today.

Who are we? Who is MMO?

MO’R Mortgage Options (MMO) is a family team of mortgage brokers.

Our story starts more than two decades ago, when Founder Michael O’Reilly began buying and selling residential property. Michael conducted EXTENSIVE research into his financing options because he didn’t want to pay a single cent more than he had to. And after personally speaking with numerous lenders, Michael discovered he wasn’t always offered the best solution or technical lending advice.

Michael knew there was a good chance other borrowers were accepting these second-rate home loan options because they were unaware of what else was available. He wanted to share what he’d learnt with others, so they too could create strong financial foundations for their families. Michael opened the doors to MMO in July 2000, committed to do exactly that.

Since that day, Michael has helped thousands of clients improve their finances, by helping them select better loans – these are families we continue to assist today. And just like a good recipe, over the last 20 odd years, the financing structures, lender knowledge and technical-know how has been passed down to the next generation with Michael’s sons Daniel and Brendan and daughter Kathryn, today leading our growing team of mortgage brokers.

We do the work. You save the money.

Book a home loan review today.

What do you get when you work with us?

Cost savings

If there’s a way to save money on your loans, we’ll find it! It may involve negotiating a cheaper interest rate. It may require switching to a loan with features you actually need. Once we’ve run the figures and work out you could save $23,000* in interest costs over 3 years, or $10,632* p.a in interest, you’ll wish you reached out to us sooner. *These are real-life interest savings we identified for homeowners simply by reviewing their existing loans.

A holistic approach to saving you money

We know it’s not always about the bottom line. You’ve got your banking and credit card working nicely and you’re happy with how you’re managing the household finances. Even if there’s a financial benefit for you to refinance, the proposed solution needs to take into account the way you like to manage your money. Your decision to refinance (or stay with your current loan) needs to benefit YOU and not just the lender.

Fast turn-around

Once you know how much extra you’re paying with each and every loan repayment, you’ll want to make changes to your loan ASAP. When you choose a mortgage broker who has been working with lenders for almost two decades – a team with intricate knowledge of the internal processing systems of Australia’s largest (and smallest) lenders – things will happen quickly once you give us the ‘go-ahead.’

Top up your loan, consolidate debt, access equity

There might be more pieces to your ‘home loan review’ puzzle. Maybe you’d like to top up your loan to renovate the kitchen. Maybe you’d like to increase your loan to consolidate personal debt. Maybe you want to release the family guarantee. When we review your loans, we don’t just check the interest rate. We’ll carefully consider what you’re hoping to achieve and ensure your home loan can help you get there.

A personal Project Manager

You’ll have someone managing the entire home loan review (and possible refinance) process for you. This means we will: perform loan comparisons and cost-benefit analysis; prepare all the paperwork; package up your loan application; liaise with your new lender for a fast approval; and manage your existing lender for a quick discharge. You’ll have someone working behind the scenes to drive the entire process for you, keeping you updated every step of the way.

As much (or as little) analysis as you like

If you’re someone who likes to see charts and tables, comparison analysis and amortisation charts before making a decision, that’s what you’ll get. If you’re more of a ‘big picture’ person and prefer a few diagrams of the recommended loan structure, that’s what you’ll get. YOU call the shots, not the other way round. You’ll get everything you need to understand why our recommended strategy really is the best course of action.

Round-the-clock Support

Some lenders process applications around the clock, meaning questions can be asked about your application outside of business hours and on weekends. It’s our job to handle all these queries, whenever they’re asked. The same goes for your own questions. Ask us anything and we’ll always do our best to respond quickly and comprehensively.

Support from an entire team

It’s frustrating when your question goes unanswered or progress seems to stop, “because Jimmy’s away and no-one else can help you.” When you work with an individual broker MMO, you get the support of our entire team – there’s always someone who can help you. Client feedback told us this was important. So many years ago, we restructured our business accordingly. It’s also the reason why many of our client reviews mention more than one person – we work in small teams to ensure you receive the best service possible.

What do you get when you work with us?

Cost savings

If there’s a way to save money on your loans, we’ll find it! It may involve negotiating a cheaper interest rate. It may require switching to a loan with features you actually need. Once we’ve run the figures and work out you could save $23,000* in interest costs over 3 years, or $10,632* p.a in interest, you’ll wish you reached out to us sooner. *These are real-life interest savings we identified for homeowners simply by reviewing their existing loans.

A holistic approach to saving you money

We know it’s not always about the bottom line. You’ve got your banking and credit card working nicely and you’re happy with how you’re managing the household finances. Even if there’s a financial benefit for you to refinance, the proposed solution needs to take into account the way you like to manage your money. Your decision to stay with your current loan needs to benefit YOU and not just the lender.

Top up your loan, consolidate debt, access equity

There might be more pieces to your ‘home loan review’ puzzle. Maybe you’d like to top up your loan to renovate the kitchen. Maybe you’d like to increase your loan to consolidate personal debt. Maybe you want to release the family guarantee. When we review your loans, we don’t just check the interest rate. We’ll carefully consider what you’re hoping to achieve and ensure your home loan can help you get there.

Fast turn-around

Once you know how much extra you’re paying with each and every loan repayment, you’ll want to make changes to your loan ASAP. When you choose a mortgage broker who has been working with lenders for almost two decades – a team with intricate knowledge of the internal processing systems of Australia’s largest (and smallest) lenders – things will happen quickly once you give us the ‘go-ahead.’

A personal Project Manager

You’ll have someone managing the entire home loan review (and possible refinance) process for you. This means we will: perform loan comparisons and cost-benefit analysis; prepare all the paperwork; package up your loan application; liaise with your new lender for a fast approval; and manage your existing lender for a quick discharge. You’ll have someone working behind the scenes to drive the entire process for you, keeping you updated every step of the way.

Round-the-clock Support

Some lenders process applications around the clock, meaning questions can be asked about your application outside of business hours and on weekends. It’s our job to handle all these queries, whenever they’re asked. The same goes for your own questions. Ask us anything and we’ll always do our best to respond quickly and comprehensively.

As much (or as little) analysis as you like

If you’re someone who likes to see charts and tables, comparison analysis and amortisation charts before making a decision, that’s what you’ll get. If you’re more of a ‘big picture’ person and prefer a few diagrams of the recommended loan structure, that’s what you’ll get. YOU call the shots, not the other way round. You’ll get everything you need to understand why our recommended strategy really is the best course of action.

Support from an entire team

It’s frustrating when your question goes unanswered or progress seems to stop, “because Jimmy’s away and no-one else can help you.” When you work with an individual broker MMO, you get the support of our entire team – there’s always someone who can help you. Client feedback told us this was important. So many years ago, we restructured our business accordingly. It’s also the reason why many of our client reviews mention more than one person – we work in small teams to ensure you receive the best service possible.

Let’s hear from some of our clients…

I have used MMO for over 5 years for all property and bank related deals.

Read MoreThis is now my third engagement with Daniel and Greg at MO’R Mortgage Options – after an initial loan application in 2010 and a refinance at the start of 2014.

Read MoreIt’s easy to be complacent and just stick with the original mortgage, even though you know there may be a better value home loan out there.

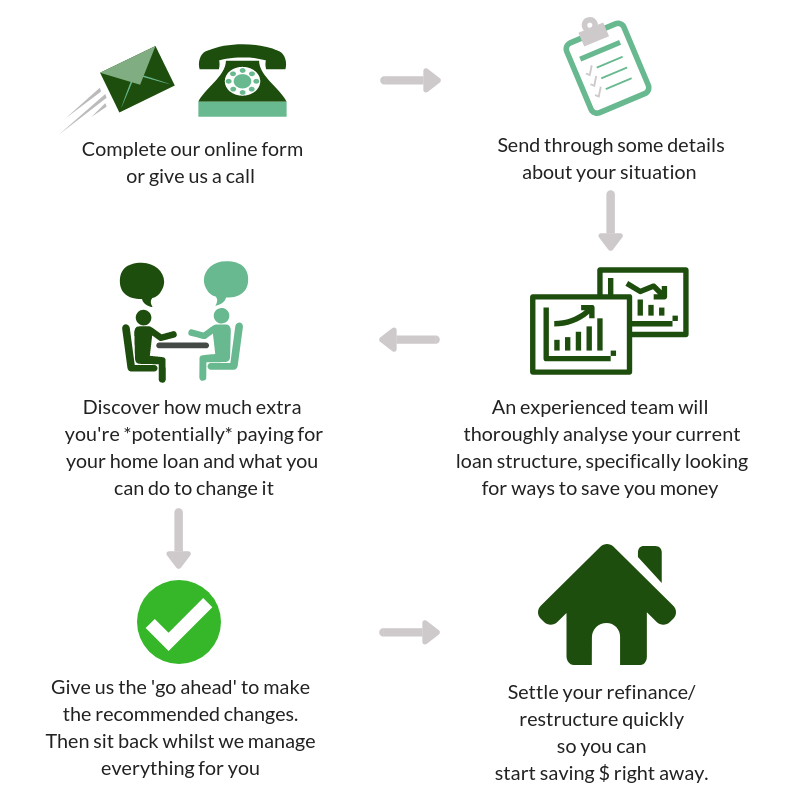

Read MoreWhat does working with us look like?

You’ll get immediate access to:

How much does our Home Loan Review Service cost?

If you’ve never worked with a broker before, you may not know our service is provided to you completely free of charge.

Yep, that’s right. You pay us nothing.

We do not charge for our service. This is not a fee-for-service transaction.

We’ll review your existing loans to identify ways you can save on your existing loans. We’ll then help you make the required changes so you can start saving right away.

Spend the next ten years benefiting from our knowledge, industry experience and technical know-how without it costing you a single cent. In fact, we’re confident you’ll save money.

— So how do we get paid then? —

Mortgage brokers are paid directly by the lender, if and when they help you secure a loan.

We’re completely transparent and upfront about this and will advise how much this could be, when we talk to you about your loan options.

A mortgage broker can access the same loan products and access the same home loan rates you could obtain directly from a lender. We can negotiate additional rate discounts on your behalf, the real benefit is in helping you find the right loan from the right lender – so you can stop paying more than you need to.

Plus, we’ll handle everything from start to finish to the entire process is as smoothly as possible.

Work with us and you’ll also receive these additional benefits…

Here are more reasons to work with us:

Regular home loan reviews

We’re on a mission to ensure no client ever pays more for their home loan than necessary. This means we’ll touch base with you regularly to review your loans to check whether they’re still competitive. This is a completely free service. And if you’re ever concerned about your loans – or something doesn’t seem right – we’re only an email away.

Ongoing support

Clients say that one of the best things about working with us over the long term is having someone to discuss their changing property plans with. ‘Can we afford to buy an investment property?’ ‘Should we lock-in to a fixed rate loan?’ are common scenarios we work through with clients. Having someone available to discuss the feasibility of your plans from a financial perspective, can save you a whole lot of time and stress. Plus, if you decide to go ahead and upgrade your home in a few years, we can help you with that too!

Access to our growing Resource Library

As a client, you’ll have access to our growing library of industry-related articles, e-books, loan scenario case-studies and other resources. You will also receive the Special Reports we generate for the Canberra Property Market – revealing suburb trends, property price growth patterns, changes in land values and housing affordability trends. We want to provide you with the information you need to make confident, informed decisions about your home (and home finances).

Work with Canberra’s best property service providers

Over the years, we’ve worked with just about everyone in town. Based on this experience and more importantly, feedback from our clients, we’ve created a “Best of the Best” List of Canberra’s best real estate agents, property managers, solicitors, accountants, financial planners, building inspectors, quantity surveyors, gardeners, builders, plumbers and electricians. If need help managing any aspect of your property, we can put you in touch with the right people.

Receive Regular Updates

Every few months we summarise what has been happening in the industry, provide commentary on market developments or potential interest rate changes and deliver it straight to your inbox. You already get a tonne of emails, most of which probably waste your time. Our Updates are short and to the point, with the sole purpose of highlighting things that may affect you and your loans (so you can do something about it if necessary).

Join our Client Referral Program

Take the opportunity to be rewarded with gifts and vouchers from some of Canberra’s best service providers and restaurants – simply by recommending us to your family and friends.

Here are more reasons to work with us:

Regular home loan reviews

We’re on a mission to ensure no client ever pays more for their home loan than necessary. This means we’ll touch base with you regularly to review your loans to check whether they’re still competitive. This is a completely free service. And if you’re ever concerned about your loans – or something doesn’t quite seem right – we’re only an email away.

Ongoing support

Clients say that one of the best things about working with us over the long term is having someone to discuss their changing property plans with. ‘Can we afford to buy an investment property?’ ‘Should we lock-in to a fixed rate loan?’ are common scenarios we work through with clients. Having someone available to discuss the feasibility of your plans from a financial perspective, can save you a whole lot of time and stress. Plus, if you decide to go ahead and upgrade your home in a few years, we can help you with that too!

Access to our growing Resource Library

As a client, you’ll have access to our growing library of industry-related articles, e-books, loan scenario case-studies and other resources. You will also receive the Special Reports we generate for the Canberra Property Market – revealing suburb trends, property price growth patterns, changes in land values and housing affordability trends. We want to provide you with the information you need to make confident, informed decisions about your home (and home finances).

Work with Canberra’s best property service providers

Over the years, we’ve worked with just about everyone in town. Based on this experience and more importantly, feedback from our clients, we’ve created a “Best of the Best” List of Canberra’s best real estate agents, property managers, solicitors, accountants, financial planners, building inspectors, quantity surveyors, gardeners, builders, plumbers and electricians. If need help managing any aspect of your property, we can put you in touch with the right people.

Receive Regular Updates

Every few months we summarise what has been happening in the industry, provide commentary on market developments or potential interest rate changes and deliver it straight to your inbox. You already get a tonne of emails, most of which probably waste your time. Our Updates are short and to the point, with the sole purpose of highlighting things that may affect you and your loans (so you can do something about it if necessary).

Join our Client Referral Program

Take the opportunity to be rewarded with gifts and vouchers from some of Canberra’s best service providers and restaurants – simply by recommending us to your family and friends.

What do other clients say about working with us?

We have just recently refinanced our home loan with the help of Brendan and his team at MO’R after putting it off for years and putting up with a bad set up and interest rates with our previous lender.

Read MoreA+ for Daniel and the team at MO’R. Decided to refinance my home loan to achieve a better interest rate, more money in the back pocket and obtain some additional funds for wedding plans.

Read MoreThe team at MMO recently assisted me in refinancing my loans and made what would have been a complicated process for me

Read More

Frequently Asked Questions

I’ve never used a mortgage broker before, why can’t I just talk to my bank?

You can – you can just talk to your bank.

But when you work with us, you’re working with a team who will hunt down your best lending option from a panel of lenders. A team who recognised in the industry as one of Australia’s best brokerages.

We can also show you how to reduce your interest costs using specific loan features and structuring techniques (that not surprisingly, lenders aren’t always so forthcoming with!)

Can I get a better deal if I go through a mortgage broker?

Mortgage brokers can access exactly the same loan products as what’s available if you walked straight into your local branch.

We can negotiate additional rate discounts on your behalf. But the real value is in helping you find the right loan from the right lender so you’re not paying any more than you need to.

We’ll also handle everything for you. This means we’ll: perform the calculations; present you with the options; package up your application; chase the lender; negotiate discounts, arrange all the paperwork; and review your loan contracts with a fine-tooth comb before you sign them. We’ll also liaise with your existing lender to ensure your loan is prepared properly for a quick discharge.

When you think about all the extra benefits you receive (at no cost!) by working with us, it’s easy to see why growing numbers of borrowers are choosing to work with mortgage brokers.

Are you sure there are no hidden fees to use your services?

There no fees for our service.

We do NOT charge any fees to calculate your Borrowing Capacity, analyse your options, tailor a buy/ sell strategy that works given your financial situation and we do not charge for our credit advice.

Likewise, we do NOT charge fees to lodge your application or manage the entire process from start to finish. Nor do we charge fees for any of the ongoing services we provide (i.e. our post-settlement check-up, helping you change/ switch your loan later on, regular home loan reviews).

If we arrange a loan for you, we receive a payment directly from the lender. We’re completely transparent and upfront about this and will advise how much this could be when we talk to you about your loan options.

I’d prefer to meet before sending you any information about my personal situation. Can I just book an appointment?

We completely understand it may seem like we’re asking for a lot of information, right at the start. The thing is though, we cannot provide the best service (or accurate credit advice) without detailed information about your existing home and related mortgage. Lenders are changing their policies all the time and without a thorough understanding of your position, we’re just guessing what might be possible.

If you want to have a general chat before sending any documentation through, please call us on 02 6286 6501.

We know there may be others who don’t ask for much information initially – and that’s completely up to them. We want to deliver the best service possible without wasting your time. We’re continually refining our processes based on client feedback and we’re confident our current systems help us to do exactly that. (Our 5 Star Facebook and Google Review Rating confirms this too.)

If we go ahead with a refinance, how long will it will take?

This depends on a few factors. Specific times (i.e. the lead up to Christmas and end of financial year) can be busier for lenders, so sometimes things can take a little longer to be processed on their end. It also depends on who your outgoing lender is, as some specific lenders take longer to prepare your loan for discharge than others.

Things can only start happening though, once you provide your supporting documentation.

Once you give us the go-ahead, we can provide an estimated timeframe.

I have multiple loans, can you help me review all of them?

Absolutely we can!

We have people within our ream who just love working with complex lending scenarios. And think nothing of spending half their day working out the best way to restructure 10 loans from 3 different lenders, secured by 6 properties across 3 states. It’s all part of a good day’s work!

Are you currently taking on new clients? Do you have capacity to review my loan?

Being a small family team of mortgage brokers, there’s a limit to the number of new clients we can take on each month. This suits us perfectly because we’re not interested in being the biggest brokerage in town. Our focus has always been on delivering quality service to quality clients.

We want to help borrowers who see value in working with a team of experienced mortgage brokers. Borrowers who know how important it is to regularly check in on their loans. Borrowers who are keen to save money!

If this sounds like you, we’re here to help. Click on the button below to get started.

Stop paying more for your loans than you have to.

We do the work.

You save the money.

Click on the button below to get started.

We’ll ask for some contact details and be in touch shortly.