Choosing Interest Only over Principal & Interest repayments on your home loan used to be an easy decision. Interest Only repayments offered flexibility, the ability to pay your loan off on your own terms and you weren’t charged a higher rate of interest for the privilege.

Choosing Interest Only over Principal & Interest repayments on your home loan used to be an easy decision. Interest Only repayments offered flexibility, the ability to pay your loan off on your own terms and you weren’t charged a higher rate of interest for the privilege.

If you’ve been keeping up with what’s been happening lately, you’d know the lending environment has significantly changed and Interest Only repayment loans aren’t what they used to be.

Lately we’ve been talking to lots of clients with Interest Only loan terms due to expire. Borrowers have been asking questions like:

- Can I extend the Interest-Only period on my loans?

- Should I extend the Interest-Only period on my loans?

- What happens if I do nothing and my loan repayments convert to Principal & Interest repayments?

- What should I do?

If you’ve been asking the same questions, here’s a few things to think about as part of your Interest Only vs Principal & Interest strategy.

Consider the effect on your cash flow

Let’s say you’ve been making Interest Only repayments on your loan for close to the last ten years and the Interest Only term is about to expire.

In the past, borrowers (especially investors) would try to extend the Interest Only period where possible or restructure their loans to establish new Interest Only periods. Due to changes in loan servicing requirements and the higher costs associated with Interest Only loans, this is not always possible – nor is it necessarily the best option. For some borrowers, the most suitable option is to start making Principal & Interest repayments.

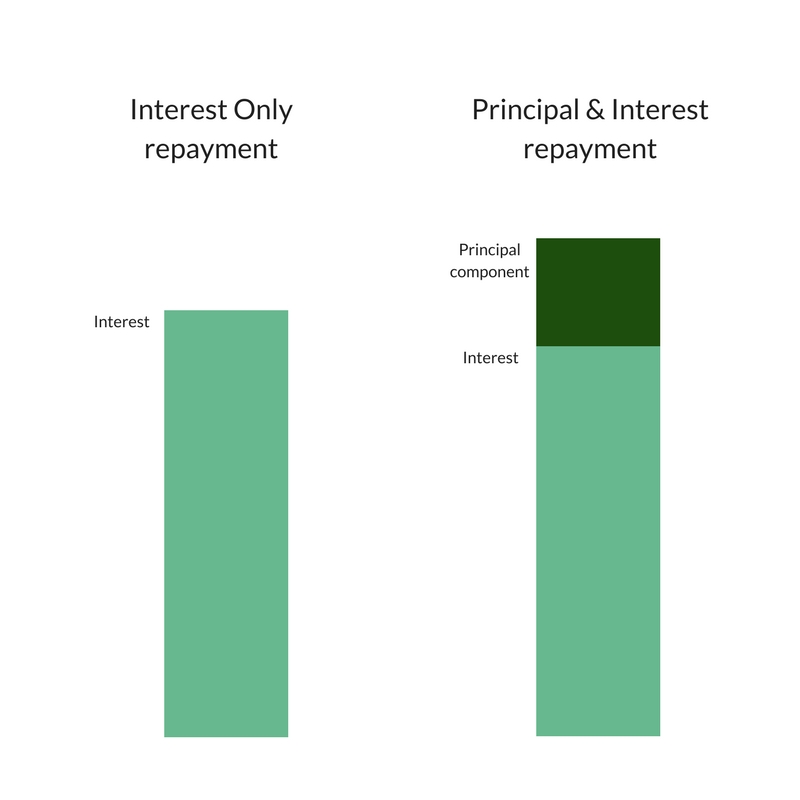

However, moving from Interest Only to Principal & Interest repayments can cause your total repayment amount to increase. Even though the rates on Principal & Interest repayment loans are lower than Interest Only repayment loans, because there’s a principal component to the repayment, your Principal & Interest repayment is higher. The impact on your cash flow can therefore be quite significant, depending on your total borrowing amount.

One way to reduce this impact is to obtain new 30 year loan terms. The Principal & Interest monthly repayment on a loan with 20 year term is going to be higher than the Principal & Interest monthly repayment on a loan with 30 year loan term – simply because you’re trying to pay the loan off in a shorter amount of time.

Whilst this strategy can increase the time it takes to pay off your loan (and potentially increase the amount of interest pay over the longer term), it can be helpful if you’re getting worried about how you’ll manage the higher Principal & Interest repayments.

Consider overall interest savings (and other benefits)

As we’ve just mentioned, the Principal & Interest repayment amount is higher than the corresponding Interest Only repayment. But because the Principal & Interest rates are lower, you end up paying less interest…. even though your overall repayment amount is higher.

Huh?

Here’s a picture to help explain what’s going on.

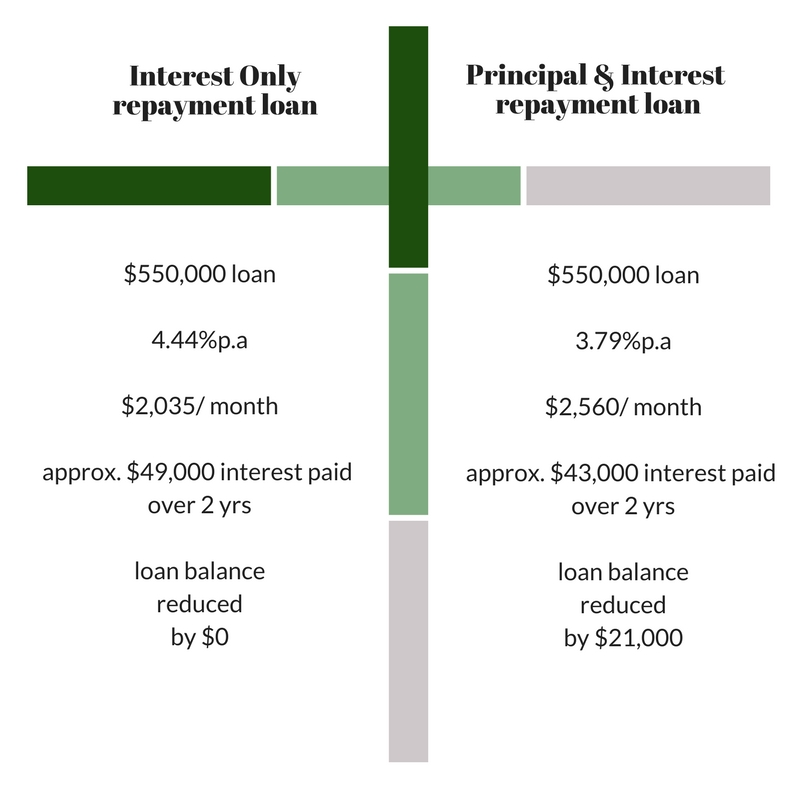

So, there’s two things we need to look at. We want to compare the total interest costs (to see where you can save interest), as well as the total repayment amount (to make sure any change in the repayment amount is manageable in terms of cash flow).

Let’s say you’re making Interest Only monthly repayments of $2,035 (at 4.44%p.a on a $550,000 home loan).

At the end of 2 years (assuming there are no offset account benefits involved), you would pay approximately $49,000 in interest costs and nothing off your home loan.

If you switch to Principal & Interest repayments at the lower rate of 3.79%, your repayments would increase to approximately $2,560. However, because you’re paying less interest, at the end of 2 years you would have paid approx. $43,000 in interest – which represents a saving of $6,000 in interest.

Plus, because you’ve been making small contributions to the principal as part of each repayment, at the end of the 2 years, you would have also paid approx. $21,000 off your loan.

Reducing the balance of your loan with Principal & Interest payments helps to reduce your interest costs even further. Since interest is calculated on your loan balance, each time you pay a little bit off your home loan the amount of interest you’re charged as part of future repayments, also reduces.

Consider diversifying your loan portfolio (ie. fixed rates & variable rates)

Consider diversifying your loan portfolio (ie. fixed rates & variable rates)

We’ve seen some good fixed rates available recently, with some lenders offering the same fixed rate for both Owner Occupier and Investment loans.

By comparing the overall repayment amount and interest costs associated with a few different borrowing options, it quickly becomes clear which strategy strikes the right balance for you.

Splitting your loan into a fixed and variable portion can also be beneficial. With the variable portion, you can pay down as much of your debt as possible – potentially using an offset account to help you reduce interest further. Whilst the fixed rate portion allows you to benefit from a competitive rate and have some comfort knowing exactly what your repayments will be for the fixed term.

It’s all about finding a solution that suits you.

Show me the numbers!

If this all makes sense in theory, but you’re someone who prefers to crunch the numbers, here’s an example of a Principal & Interest vs Interest Only repayment loan comparison we recently prepared for an investor client. The analysis was prepared as part of a regular home loan review and takes into account everything we’ve talked about here.