What can you do about it?

You can’t be in a strong position financially without solid foundations in place. It all starts with your home loan.

Following the budget announcement early in May, the Big Bank Tax has received significant attention in the media. And rightly so, because it could see the biggest banks raise up to $6 billion over the next four years, if the forecasts are accurate (something which has been hotly debated).

Whilst the major lenders hit back early in strong opposition to the proposal, it’s now looking extremely likely that the Big Bank Tax will be introduced.

But who will end up paying for it?

Market commentators believe the cost will be passed on to consumers one way or another, with banks potentially implementing a range of measures to fund the tax. One suggestion is to cut rates on bank deposits. Another is to increase interest rates on home loans.

Comments made by Bank CEO’s have provided fuel to speculation as to how this tax will be funded…. “There is no such thing as a cost being absorbed,” “No company can simply absorb a new tax,” “Customers or staff will have to pay.” (‘Bank Levy to Come at a Price,’ by Michael Smith, Australian Financial Review, 22 May 2017)

If the Big Bank Tax is coming for you by way of increased home loan rates, what can you do about it?

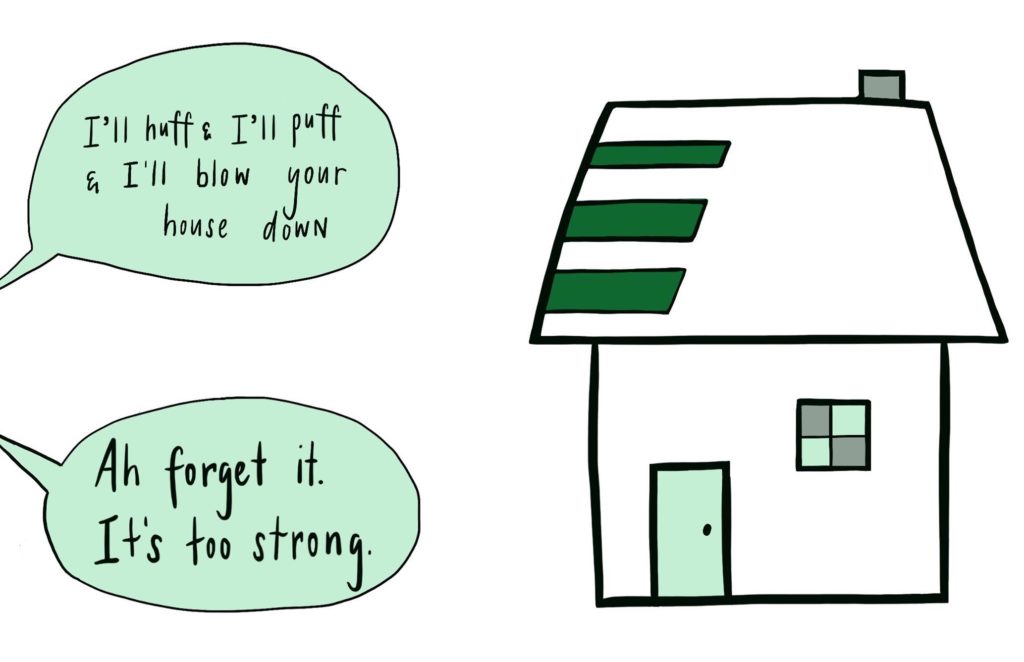

(Well for one, it might be a good idea to stay away from home loans involving straw or sticks…. we’re kidding of course – sort of.)

In all seriousness though, in times of speculation and uncertainty concerning interest rates, we’ve always found the best course of action is to focus on things you can actually control.

This means it’s time to do everything you can to ensure your financial situation is as secure as it can be. It means checking up on the foundations (i.e. your home loan structure) to ensure it’s solid and you’re not spending extra money on things you don’t need to – like additional interest costs.

You wouldn’t offer to pay full price for something on sale, so why are you happy to pay more interest if you don’t have to?

We’re not talking here about refinancing away from a major lender just because you think interest rates may rise. What we’re suggesting is examining your current situation to see if there are any tweaks to be made.

Is your home loan helping to put you in a strong position financially?

Answer these questions to find out…

1. Do you know how your current home loan compares to others in the market?

Most home owners don’t even know what rate of interest they are paying on their home loans. Many more don’t even know what fees they’re paying, or what features they’re paying for.

Does this sound like you?

If you’re a fan of the ‘set and forget’ approach (which is fine – for a period of time), please make sure the ‘forget’ phase doesn’t last too long, otherwise you’re potentially just wasting hard earned money.

2. Has a mortgage professional reviewed your home loans over the past 18 months?

We completely understand why this important job is overlooked.

You’re busy. You have lots going on. You’re barely managing to keep on top of your day-to-day jobs.

You don’t have time to come and see us. We get it.

The thing is though, it’s actually super easy (much easier than you think) to ask us to review your home loans. It’s even easier if you’re an existing client.

Just send us an email and we’ll see if there’s anything we can do to help save you money. You don’t even need to take time out of your day to come in and meet us. More often than not, it can all be done via phone or email.

3. Are you on track to achieve your longer term plans?

Do you want to upgrade your home in 2 years? Are you keen to buy an investment property soon but not sure how?

Do you have a plan in mind, but not sure whether you can actually achieve it? Do you feel like you’re just treading water?

That’s why we’re here.

We can help map out a plan for your longer term goals, and suggest some milestones along the way to make it seem more achievable.

We love nothing more than helping someone achieve different goals throughout their various stages of life; we’ve been lucky enough to help some clients for the last 15 years!

If you can’t confidently say ‘yes’ to the questions above, things might not be solid as you think.

There’s absolutely no reason for you to personally absorb avoidable costs on your home loan.

We’re here (armed with a suite of over 30+ lenders) ready to help you get into the strongest financial position possible. All you have to do is ask.