We have talked before about fixed vs variable loans, and when a fixed rate loan can be beneficial. We’ve also looked at the tools we use to help us determine when might be a good time to fix.

Over the last few weeks, we’ve had lots of clients ask us, “What about now? Is now a good time to fix?”

So we thought it might be a good time to look at some current data.

The Historical approach

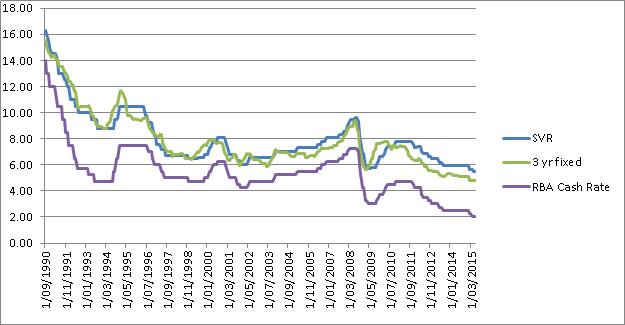

The following charts the RBA Cash Rate, Standard Variable Rate (SVR) and the 3yr Fixed Rate over the last 25 years (using Indicator Lending Rates available from the RBA – data labelled as F5).

If you apply technical analysis, you could mount an argument that when the 3yr Fixed Rate moves above the SVR line, it’s possibly indicating that the SVR is about to rise (meaning you could do well with a fixed rate). Conversely, when the 3yr Fixed Rate changes direction and moves below the SVR, it could signal that the SVR is about to drop (and you may be better staying variable).

The Future approach

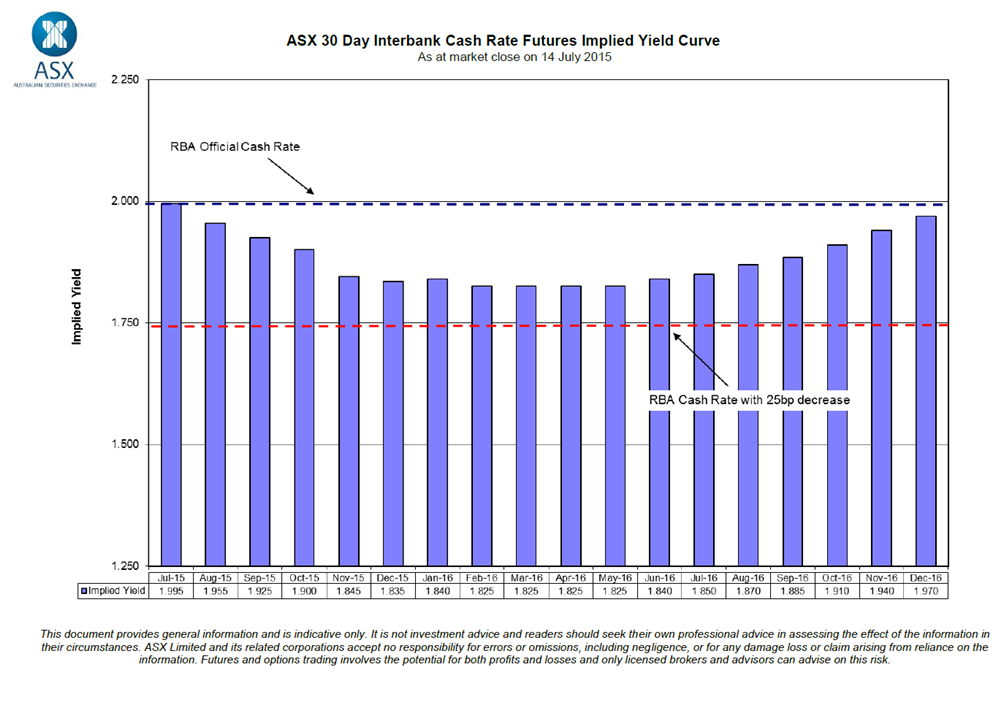

We can look ‘into the future’ by examining the Interbank Cash Rate futures market. The RBA Rate Tracker plots a curve based on what’s trading at what prices in the future.

There’s a bit of ‘looking into the crystal ball’ when it comes to predicting the movements of interest rates. However, we’ve found the above tools to be quite useful to obtain a short/ medium term outlook of what rates are expected to do.

The most important thing is that any loan (whether it be a fixed or variable rate loan) meets your overall objectives and incorporates the broader picture. The last thing you want to do is lock into a 3 year fixed rate loan if you intend selling the property in a year from now.

If you have any specific questions about your own personal situation, just let us know.